- Fed minutes, extra earnings, Thanksgiving/Black Friday might be in focus this week.

- Nvidia is a purchase with one other beat-and-raise quarter anticipated.

- Deere is a promote with disappointing steering on deck.

- Searching for extra actionable commerce concepts to navigate the present market volatility? Members of InvestingPro get unique concepts and steering to navigate any local weather. Study Extra »

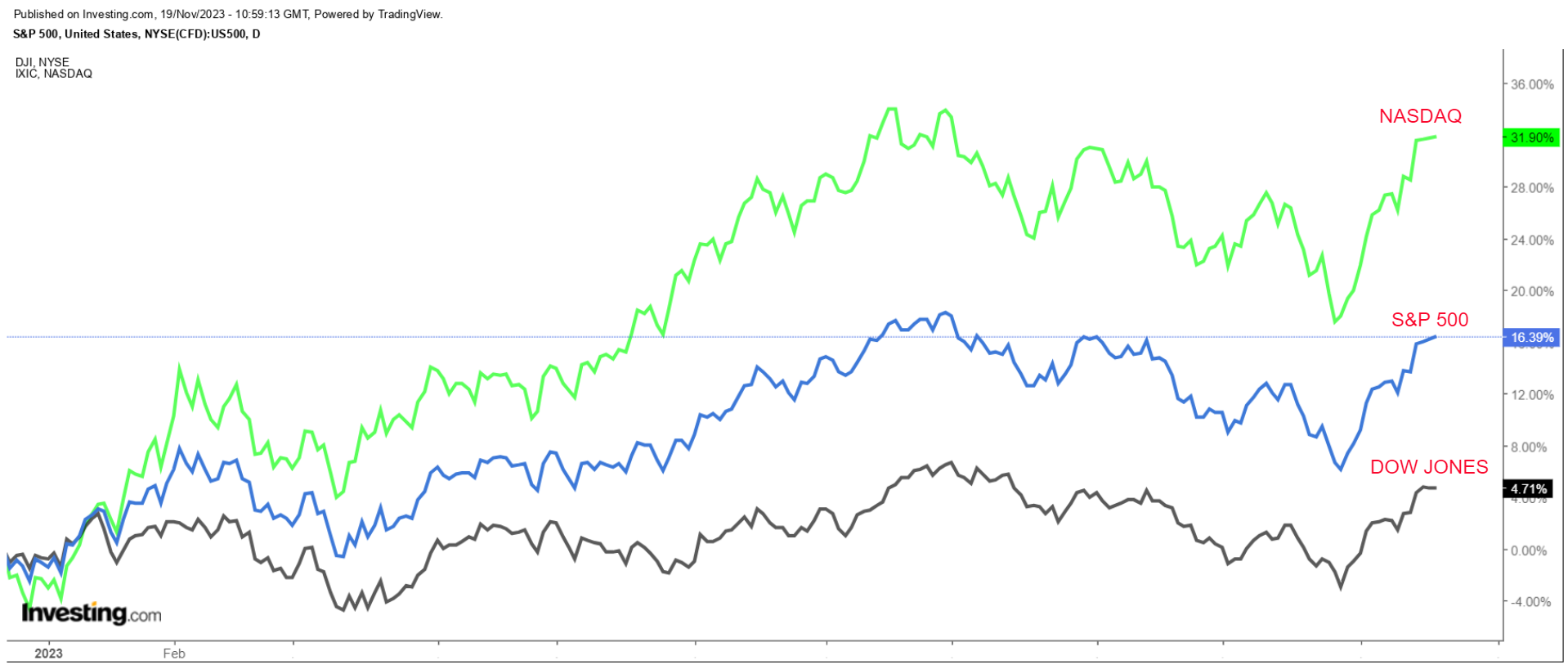

Wall Road’s three main indexes closed barely increased on Friday to notch their third straight profitable week as buyers held quick to the assumption that U.S. rates of interest have peaked and would possibly even fall subsequent 12 months.

For the week, the blue-chip rose 1.9%, the benchmark climbed 2.2%, and the tech-heavy jumped 2.4%.

Shares have been on a tear this month, with the Nasdaq up 9.9% amid indicators of cooling inflation which have fueled hopes that the Federal Reserve is completed elevating rates of interest.

With the Thanksgiving vacation simply across the nook, Wall Road may have a shortened week of buying and selling forward. The inventory market will stay shut on Thanksgiving Day – Thursday – and can shut early at 1:00PM ET on Friday.

There’ll, nevertheless, be a full slate of financial knowledge releases popping out within the days prior as buyers proceed to weigh the Fed’s price plans for the months forward.

On the financial calendar, most vital would be the minutes of the Federal Reserve’s November FOMC assembly.

In the meantime, the reporting season’s final large week sees earnings roll in from market heavyweight Nvidia, in addition to a number of retailers similar to Lowe’s (NYSE:), Greatest Purchase (NYSE:), Kohl’s (NYSE:), Nordstrom (NYSE:), and Dick’s Sporting Items (NYSE:).

Different notable firms embrace Deere, Zoom Video (NASDAQ:), Autodesk (NASDAQ:), and Baidu (NASDAQ:).

No matter which route the market goes subsequent week, beneath I spotlight one inventory more likely to be in demand and one other which may see recent draw back.

Keep in mind although, my timeframe is simply for the week forward, Monday, November 20 – Friday, November 24.

Inventory to Purchase: Nvidia

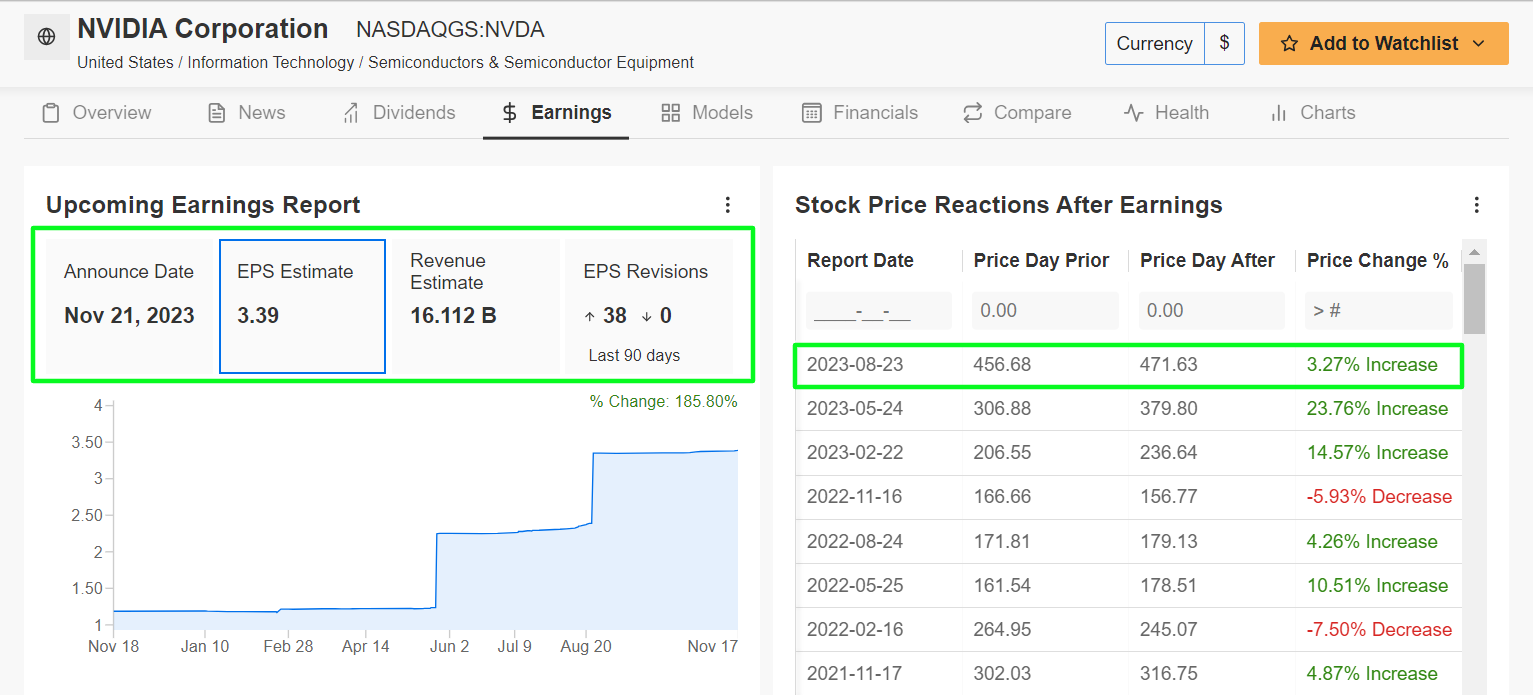

I anticipate Nvidia (NASDAQ:) to increase its march increased this week, probably culminating in a breakout to a brand new all-time peak, because the tech big prepares to ship one other beat-and-raise quarterly earnings report amid hovering demand for its AI chips.

Nvidia is scheduled to launch its Q3 replace after the U.S. market shut on Tuesday, November 21 at 4:20PM ET, and it’s anticipated to shatter its gross sales document as soon as once more as development prospects in synthetic intelligence stay sturdy.

A name with CEO Jensen Huang is ready for five:00PM ET.

Market individuals anticipate a large swing in NVDA shares following the print, as per the choices market, with a potential implied transfer of round 8% in both route. Shares rose about 3% after its final earnings report in late August.

As may very well be anticipated, an InvestingPro survey of analyst earnings revisions factors to mounting optimism forward of the print amid the speedy shift into accelerated computing and generative AI.

Revenue estimates have been revised upward 38 instances within the final three months, in comparison with zero downward revisions. In the meantime, 50 out of 53 analysts masking NVDA have a Purchase-equivalent ranking on the inventory.

Consensus expectations name for Nvidia to publish third quarter earnings of $3.39 per share, surging 485% from EPS of $0.58 within the year-ago interval. If that’s in truth actuality, it will mark Nvidia’s most worthwhile quarter in its 30-year historical past.

In the meantime, income is forecast to skyrocket 172% year-over-year to $16.11 billion, because the tech chief advantages from hovering demand for its A100 and H100 AI chips, which have turn out to be a typical in AI improvement.

As such, I imagine chief govt Jensen Huang will present better-than-expected revenue and gross sales steering for the present quarter and past because the Santa Clara-based firm stays properly positioned to thrive amid the present surroundings.

Key matters more likely to come up might be additional particulars on AI companies income and the influence of tighter China export controls, in addition to an replace on the info middle provide chain.

NVDA inventory ended Friday’s session at $492.98, just under its document excessive of $502.66 reached on August 24. At present ranges, Nvidia has a market cap of $1.2 trillion, making it the fifth most useful firm buying and selling on the U.S. inventory change.

Shares are up a whopping 237% in 2023, making Nvidia the top-performing S&P 500 inventory of the 12 months, due to ongoing AI-related buzz.

Inventory to Promote: Deere

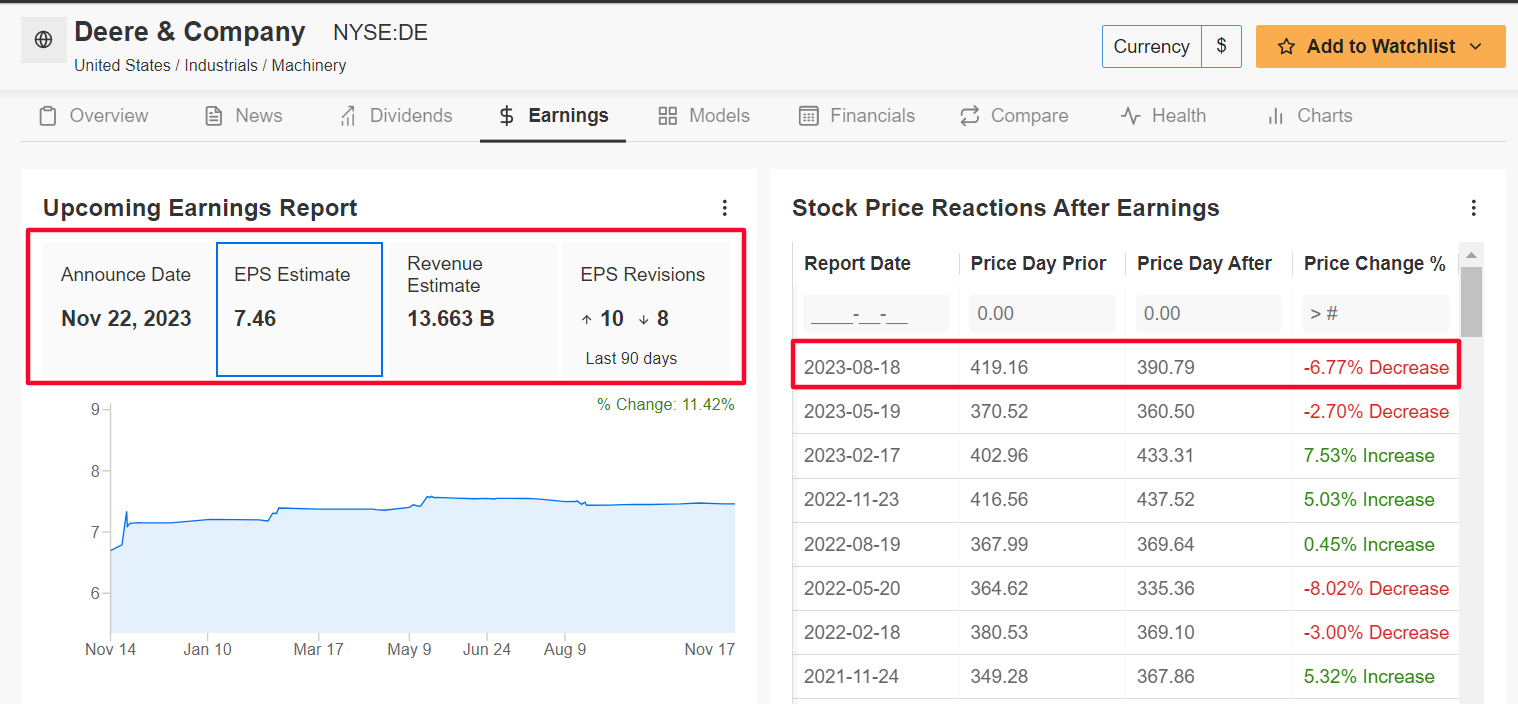

I imagine Deere (NYSE:) inventory will undergo a difficult week forward because the agriculture-and-heavy equipment tools maker’s newest earnings and outlook will disappoint on account of declining trade demand developments and an unsure elementary outlook.

Deere’s fiscal fourth quarter report is due forward of Wednesday’s opening bell and outcomes are more likely to take a success from indicators of slowing world equipment demand amid the difficult financial surroundings.

As per strikes within the choices market, merchants are pricing in a swing of about 5% in both route for DE inventory following the discharge. Shares tumbled virtually 7% after its fiscal Q2 report got here out in mid-August.

It needs to be famous that eight out of 18 analysts surveyed by InvestingPro have reduce their earnings estimates within the 90 days main as much as the print, as Wall Road turned cautious on the tractor maker’s prospects.

Deere is seen incomes $7.46 a share for its fiscal fourth quarter, nearly unchanged from EPS of $7.44 within the year-ago interval.

In the meantime, income is forecast to dip 4.8% yearly to $13.66 billion, reflecting slowing demand for its wide selection of agricultural, mining, and development tools amid worries over the well being of the worldwide financial system.

Deere reported a revenue of $10.20 a share from gross sales of $15.8 billion within the fiscal third quarter of 2023.

Wanting forward, I anticipate the agriculture big will disappoint buyers with its ahead steering, given the unsure outlook for farm and mining equipment gross sales in a slowing financial system.

DE inventory closed at $384.15 on Friday, incomes the Moline, Illinois-based heavy tools maker a valuation of $110.6 billion.

With lower than two months to go in 2023, Deere shares are down 10.4% year-to-date, and are practically 15% beneath their July excessive of $450.

Shares have come underneath strain on account of investor issues over the outlook for the farming and mining industries amid renewed fears over the worldwide financial system.

Be sure you try InvestingPro to remain in sync with the most recent market developments and what they imply on your buying and selling selections.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Know-how Choose Sector SPDR ETF (NYSE:). I often rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and firms’ financials. The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.