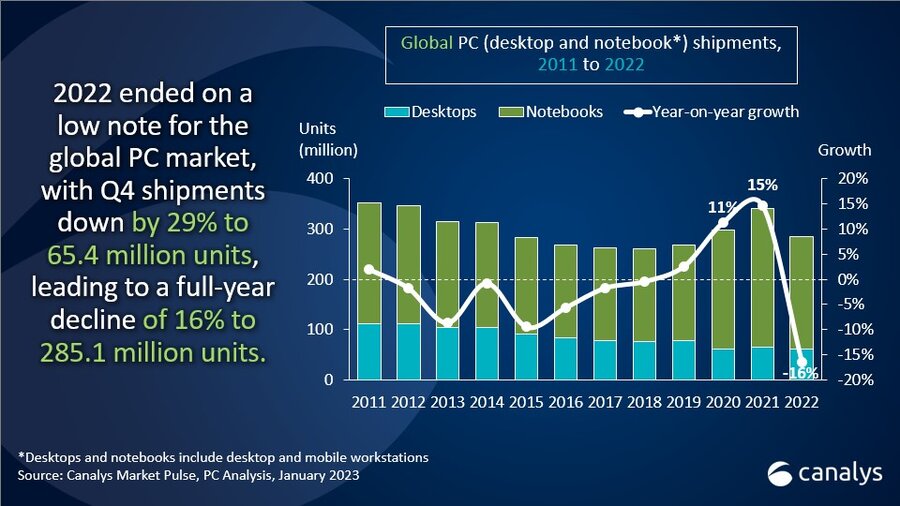

The worldwide PC market ended 2022 on a low observe, with complete shipments of desktops and notebooks down by 29% to 65.4 million items in This fall. This represents a fourth consecutive quarter of decline as vacation season spending was muted amid a worsening financial surroundings. This pegged complete shipments for full-year 2022 at 285.1 million items, a 16% drop from the highs of 2021 when all end-user segments noticed peak demand. Nonetheless, cargo volumes stay favorable in comparison with pre-pandemic, with complete 2022 shipments 7% greater than in 2019. Notebooks underwent a bigger decline, down by 30% to 51.4 million items in This fall 2022 and 19% to 223.8 million items for the complete 12 months. Desktops fared barely higher, present process a decline of 24% to 14.1 million items in This fall and a drop of seven% to 61.3 million items throughout 2022.

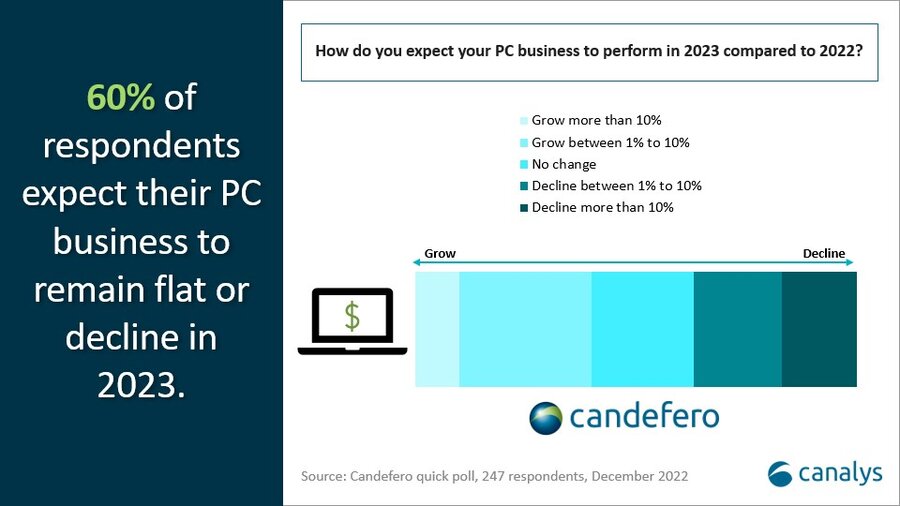

“As anticipated, the worldwide PC market confronted additional headwinds in This fall to spherical out what has been a tough 2022,” stated Ishan Dutt, Senior Analyst, Canalys. “The decline is particularly stark because the corresponding interval in 2021 caused file shipments of notebooks and desktops. Distributors and retailers aimed to stimulate client spending with heavy discounting, however regardless of pockets of success, this was not sufficient to drive vital new sell-in. With rising prices for power and fundamental items in key markets just like the US and Europe, expenditure on big-ticket objects like PCs has taken a again seat as customers are ready to delay refreshes. In the meantime, on the industrial entrance, each private and non-private sector budgets confronted tightening amid rising rates of interest, slowdowns in hiring and expectations of a recession early this 12 months. A December 2022 ballot of round 250 channel companions confirmed that 60% anticipate their PC enterprise income to stay flat or decline in 2023. This difficult surroundings for the PC business is anticipated to final till the second half of this 12 months.”

“Regardless of the short-term problem, the long-term outlook for PCs stays optimistic,” added Dutt. “Shipments in 2022 had been down by 16%, and we anticipate an extra contraction in 2023, however in each years, complete volumes will stay greater than within the pre-pandemic period of 2019. As soon as companies and customers journey out the storm, we anticipate delayed purchases to start boosting the market in late 2023, with momentum selecting up in 2024. This can be bolstered by an training demand bump in main markets as units deployed in the course of the pandemic peak attain the tip of their life cycle. And even in the course of the downturn, there can be areas that may ship success for the business, similar to gaming, related PCs and hybrid work, all of which had been highlighted by bulletins at CES 2023.”

Lenovo secured the highest spot within the PC market in This fall 2022, with shipments totaling 15.5 million items, representing a 29% year-on-year decline. It was additionally the most important transport vendor for the full-year 2022, posting 68.1 million items because it underwent a 17% decline in comparison with 2021. HP ranked second, additionally seeing shipments decline by 29% in This fall to a complete of 13.2 million items. For the full-year 2022, it noticed shipments fall by 25% to 55.2 million items. Third-placed Dell suffered the most important decline among the many high distributors in This fall, with shipments down by 37% to 10.8 million items. Nevertheless, its energy in industrial earlier in 2022 meant its complete shipments had been down by 16% to 49.7 million items. Apple was positioned fourth in each the This fall and full-year rankings, ending 2022 with 27.2 million Macs shipped for a 6% decline, whereas Asus rounded out the highest 5 with a modest decline of 4% in comparison with its 2021 shipments.

|

Worldwide desktop and pocket book shipments (market share and annual development) |

|||||

|

Vendor (firm) |

This fall 2022 |

This fall 2022 |

This fall 2021 |

This fall 2021 |

Annual |

|

Lenovo |

15,470 |

23.6% |

21,758 |

23.7% |

-28.9% |

|

HP |

13,200 |

20.2% |

18,595 |

20.3% |

-29.0% |

|

Dell |

10,807 |

16.5% |

17,195 |

18.7% |

-37.2% |

|

Apple |

7,229 |

11.0% |

7,812 |

8.5% |

-7.5% |

|

Asus |

4,866 |

7.4% |

6,076 |

6.6% |

-19.9% |

|

Others |

13,868 |

21.2% |

20,281 |

22.1% |

-31.6% |

|

Whole |

65,440 |

100.0% |

91,717 |

100.0% |

-28.7% |

|

|

|

|

|

||

|

Observe: Unit shipments in 1000’s. Percentages could not add as much as 100% as a consequence of rounding. Supply: Canalys PC Evaluation (sell-in shipments), January 2023 |

|

||||

|

Worldwide desktop and pocket book shipments (market share and annual development) |

|||||

|

Vendor (firm) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Lenovo |

68,125 |

23.9% |

82,200 |

24.1% |

-17.1% |

|

HP |

55,206 |

19.4% |

74,022 |

21.7% |

-25.4% |

|

Dell |

49,746 |

17.4% |

59,300 |

17.4% |

-16.1% |

|

Apple |

27,160 |

9.5% |

28,961 |

8.5% |

-6.2% |

|

Asus |

20,616 |

7.2% |

21,473 |

6.3% |

-4.0% |

|

Others |

64,237 |

22.5% |

75,081 |

22.0% |

-14.4% |

|

Whole |

285,090 |

100.0% |

341,037 |

100.0% |

-16.4% |

|

|

|

|

|

||

|

Observe: Unit shipments in 1000’s. Percentages could not add as much as 100% as a consequence of rounding. Supply: Canalys PC Evaluation (sell-in shipments), January 2023 |

|

||||

For extra data, please contact:

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

About PC Evaluation

Canalys’ PC Evaluation service gives quarterly up to date cargo information to assist with correct market sizing, aggressive evaluation and figuring out development alternatives available in the market. Canalys PC cargo information is granular, guided by a strict methodology, and is damaged down by market, vendor and channel, in addition to extra splits, similar to GPU, CPU, storage and reminiscence. As well as, Canalys additionally publishes quarterly forecasts to assist higher perceive the longer term trajectory and altering panorama of the PC business.

About Canalys

Canalys is an unbiased analyst firm that strives to information purchasers on the way forward for the expertise business and to assume past the enterprise fashions of the previous. We ship good market insights to IT, channel and repair supplier professionals world wide. We stake our repute on the standard of our information, our progressive use of expertise and our excessive stage of customer support.

Receiving updates

To obtain media alerts straight, or for extra details about our occasions, providers or customized analysis and consulting capabilities, please contact us. Alternatively, you possibly can e mail press@canalys.com.

Please click on right here to unsubscribe

Copyright © Canalys. All rights reserved.