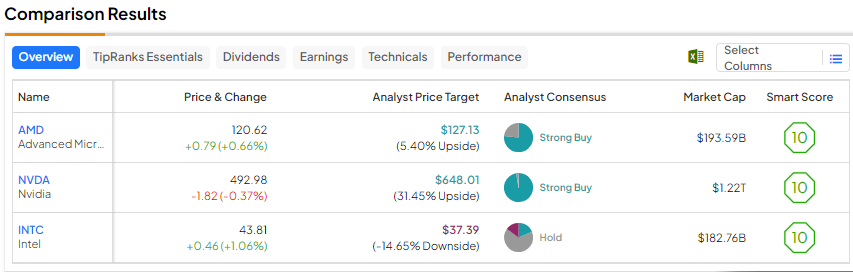

Chip corporations have been in focus this yr as a result of large alternative created by the generative synthetic intelligence ambitions of tech giants following the success of OpenAI’s ChatGPT. Additional, after struggling for a number of quarters, many semiconductor corporations may gain advantage from the gradual restoration anticipated within the PC market subsequent yr. Bearing this backdrop in thoughts, we used TipRanks’ Inventory Comparability Instrument to position Superior Micro Gadgets (NASDAQ:AMD), Nvidia (NASDAQ:NVDA), and Intel (NASDAQ:INTC) to search out the most effective chip inventory as per Wall Avenue consultants.

Superior Micro Gadgets (NASDAQ:AMD)

Whereas Nvidia has stolen the limelight from all different semiconductor shares this yr as a result of demand for its graphics processing models (GPUs) in generative AI, a number of analysts stay bullish about Superior Micro Gadgets’ potential to seize the alternatives within the generative AI area.

The corporate is predicted to profit within the upcoming quarters from the demand for its newest MI300 chips and restoration within the PC market. In the course of the Q3 earnings name, administration stated that it expects AMD’s Information Middle GPU income to be about $400 million within the fourth quarter and surpass $2 billion in 2024, backed by the demand for MI300 chips. This, as per the corporate, would make MI300 its quickest product to ramp to gross sales of $1 billion.

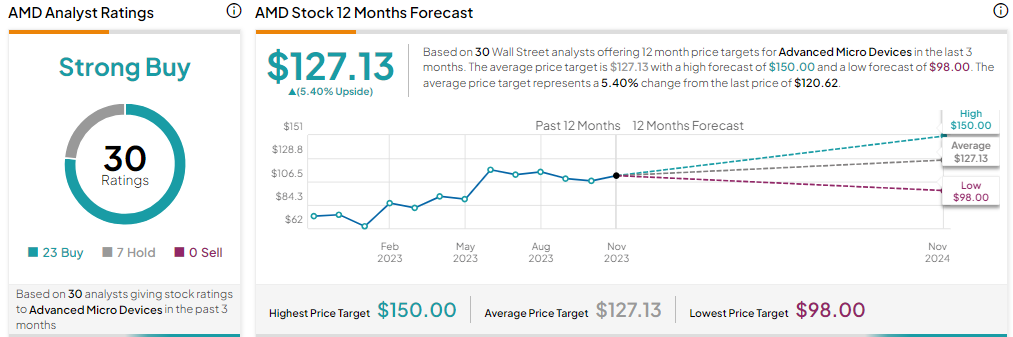

Is AMD a Purchase, Promote, or Maintain?

On November 13, Roth MKM analyst Sujeeva De Silva initiated protection of AMD inventory with a worth goal of $125. The analyst identified that AMD’s premium valuation of P/E (price-to-earnings a number of primarily based on calendar yr 2024 earnings estimates) of 33x, in comparison with the general know-how friends’ common P/E of 26x, displays the corporate’s relative development alternative.

De Silva believes that the corporate’s differentiated portfolio of high-performance compute and networking processors and accelerators characterize a strong funding alternative. He added that the corporate is well-positioned from a product portfolio perspective to handle the rising knowledge middle infrastructure market. Additionally, checks by the analyst’s agency reveal that AMD is poised to win additional market share within the cloud server area and is making progress within the enterprise market.

With 23 Buys and 7 Holds, AMD scores Wall Avenue’s Robust Purchase consensus score. At $127.13, the typical worth goal suggests a modest upside potential of 5.4%. Shares have jumped greater than 86% to date in 2023.

Nvidia (NASDAQ:NVDA)

This yr has been a outstanding one for Nvidia. The generative AI-induced demand for the corporate’s superior GPUs has helped NVDA ship stellar leads to current quarters and triggered a 237% year-to-date rally within the inventory. The corporate’s GPUs are being utilized by a number of tech giants to construct and prepare generative AI fashions.

Following the sturdy efficiency within the first half of the fiscal yr, expectations are excessive from Nvidia’s fiscal third-quarter outcomes, scheduled to be introduced on November 21. Analysts count on the corporate’s Q3 FY24 income to surge 173% year-over-year, backed by strong Information Middle enterprise. This income development estimate displays additional acceleration in NVDA’s top-line development in comparison with 101% in Q2 FY24. Wall Avenue expects adjusted EPS to leap to $3.37 in Q3 FY24 from $0.58 within the prior-year quarter.

What’s NVDA Value Goal?

On the just lately held Supercomputing 23 occasion, Nvidia unveiled its HGX H200 AI accelerator, which is an improve to the H100. Financial institution of America analyst Vivek Arya famous that the H200 is suitable with its predecessor H100 installations, which is able to facilitate sooner time to market and is in reality “crucial,” provided that hyperscalers don’t want to take a position to reconfigure their present {hardware} platform to the upgraded providing.

Arya believes that improve simplicity enhances the aggressive portfolio that Nvidia holds. Calling NVDA his “high decide,” the analyst reiterated a Purchase score on the inventory with a worth goal of $650 on November 13.

Together with Arya, 37 analysts have a Purchase advice for Nvidia whereas just one analyst has a Maintain score. The typical worth goal of $648.01 implies 31.5% upside potential.

Intel (NASDAQ:INTC)

Intel shares have rallied greater than 21% over the previous one month and are up 66% year-to-date. The corporate’s better-than-projected third-quarter efficiency impressed traders. The corporate’s adjusted EPS elevated practically 11% to $0.41 per share, simply exceeding analysts’ adjusted EPS estimate of $0.22.

Regardless of an 8% decline in Q3 2023 income to $14.2 billion, adjusted EPS elevated as a result of firm’s expense self-discipline. After dropping market share to rivals like AMD lately, Intel is now specializing in bettering the competitiveness of its choices and streamlining its enterprise. The corporate additionally goals to enhance its profitability and is focusing on value financial savings of $8 billion to $10 billion by 2025.

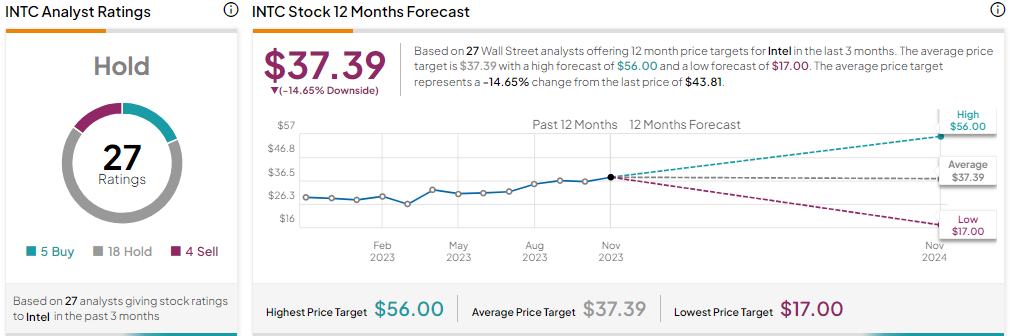

What’s the Prediction for Intel Inventory?

Mizuho analyst Vijay Rakesh just lately upgraded Intel inventory, citing many upcoming server product rollouts and foundry buyer bulletins. That stated, most analysts stay cautious about Intel, together with Morgan Stanley analyst Joseph Moore.

In late October, Moore raised his worth goal for Intel to $39 from $35 and reiterated a Maintain score on the inventory. Whereas the analyst acknowledged that Q3 was an excellent quarter for Intel primarily as a consequence of PCs, he thinks that the “knowledge middle malaise” continued within the quarter. Consequently, he saved his second-half estimates primarily unchanged. Whereas Moore expects the current outcomes to profit the inventory over the close to time period, he contends that for Intel the “focus is the roadmap, not numbers.”

Total, Wall Avenue’s Maintain consensus score on INTC inventory relies on 5 Buys, 18 Holds, and 4 Sells. The typical worth goal of $37.39 implies a potential draw back of 14.6% from present ranges.

Conclusion

Analysts are bullish on Superior Micro Gadgets and Nvidia, whereas they’re sidelined on Intel, as many suppose that there’s rather more to be performed for the corporate to enhance its competitiveness within the chip market. Regardless of the exceptional year-to-date rally in Nvidia shares, Wall Avenue continues to see greater upside potential within the inventory than AMD and Intel.

Disclosure

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

Source link