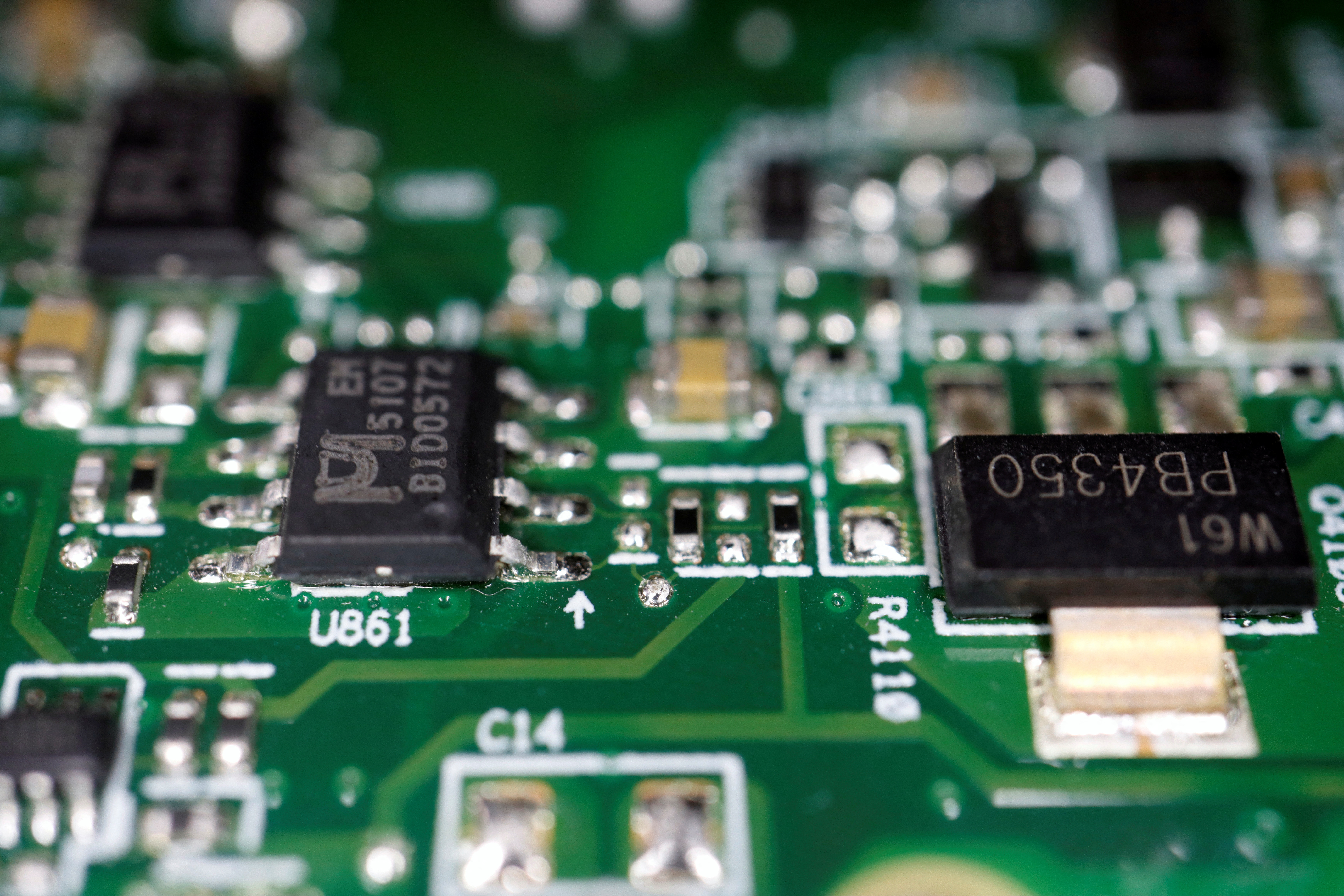

Semiconductor chips are seen on a printed circuit board on this illustration image taken February 17, 2023. REUTERS/Florence Lo/Illustration Purchase Licensing Rights

WASHINGTON, Oct 17 (Reuters) – The Biden administration’s newest spherical of export curbs on China is a part of a two-pronged technique aiming to halt Beijing’s technological advances over fears it may use the improvements to bolster its army, whereas on the identical time spending billions to lure extra chip manufacturing again to the U.S.

On Tuesday, the U.S. introduced new measures that search to tighten restrictions and shut loopholes in a slew of recent guidelines introduced final October. These guidelines aimed to stem the stream of high-end American synthetic intelligence chips and chipmaking instruments into China.

As the US has slashed the quantity of high expertise headed to China, it has additionally been utilizing the promise of billions of {dollars} of funding to entice non-Chinese language chipmakers to arrange store, or increase operations, in the US.

“Chips are on the heart of the administration’s financial safety and nationwide safety agenda in terms of managing the competitors with China,” mentioned Emily Kilcrease, senior fellow on the Heart for a New American Safety and former deputy assistant U.S. Commerce Consultant.

The USA has been locked in a expertise conflict with China since former President Trump blacklisted Chinese language telecoms big Huawei in 2019. The transfer heightened tensions between the 2 nations and compelled U.S. suppliers to get a particular license earlier than promoting to the corporate.

Whereas President Joe Biden has taken goal at fewer big-name Chinese language corporations since taking workplace in 2021, his administration has stepped up its efforts to maintain China from advancing in three key fields: semiconductors, synthetic intelligence, and quantum computing.

The very best examples of those efforts are the export controls unveiled final October, and an govt order launched in August, which forces traders to inform the federal government of most transactions in these sectors whereas banning a smaller subset.

“The Biden administration is pivoting from a previous technique of ‘the U.S. ought to keep a pair generations forward of China in chip design and manufacturing’ to ‘we should always keep as far forward as we will on chip design and manufacturing,’” mentioned Peter Harrell, a former Biden administration official who mentioned the change was resulting from a recognition of the big selection of functions for semiconductor chips with nationwide safety implications.

China has reacted to the measures by accusing the U.S. of utilizing nationwide safety to justify financial bullying of its corporations. It has additionally hit again with raids of U.S. companies working there and banned Chinese language corporations from working with U.S. chipmaker Micron.

BILLIONS FOR CHIPS

The USA, in the meantime, has been serving to non-Chinese language chipmakers negotiate with states like Arizona, Texas and New York to arrange store or develop present operations.

In line with the Semiconductor Business Affiliation, the share of worldwide semiconductor manufacturing capability within the U.S. has decreased from 37% in 1990 to 12% in 2022.

With avid White Home help, Congress handed the landmark “Chips and Science” legislation in 2022, which supplies $52.7 billion for U.S. semiconductor manufacturing, analysis and workforce growth.

Chipmakers each international and home have lined as much as ask for a share of the $39 billion earmarked for semiconductor manufacturing, from Taiwan’s TSMC to South Korea’s Samsung and U.S.-based Intel.

Corporations have already introduced plans to construct or increase U.S.-based fabs, and awards are anticipated to be introduced in brief order. Intel, for instance, introduced a $20 billion funding to construct a brand new mega chip manufacturing facility in Ohio in January, and hopes to make use of among the Chips and Science Act cash to pay for it.

Past the tech realm, the U.S. and China stay at odds over points from Taiwan and pressure within the South China Sea to commerce, fentanyl and human rights.

Reporting by Alexandra Alper; modifying by Jonathan Oatis

Our Requirements: The Thomson Reuters Belief Rules.