Liontrust’s international innovation crew believes a brand new tech cycle is dawning and this 12 months’s AI-fuelled rally is simply the beginning of issues to come back.

The Nasdaq 100 index has climbed a formidable 47% this 12 months however the rally in expertise shares is simply simply getting began, in accordance with Liontrust Asset Administration.

Its international innovation crew believes Nvidia, Microsoft and Tesla are undervalued on a five-year view given their progress prospects and {that a} new multi-year tech cycle, fuelled by synthetic intelligence (AI), will increase productiveness throughout an unlimited swathe of industries.

James Dowey, who co-heads the crew, mentioned: “We imagine we’re proper at first of a brand new tech cycle. It’s primarily based on AI. We imagine it should create lots of worth and lots of alternatives.”

The magnificent seven are undervalued for his or her progress potential

Regardless of this 12 months’s rally in tech shares, particularly amongst the ‘magnificent seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) the worldwide innovation crew argued that the market is undervaluing their potential.

Nvidia’s share worth has risen 234% 12 months up to now, however it’s on observe to develop its earnings by 440% this 12 months in comparison with 2022, so Nvidia’s valuation – excessive because it seems – has truly did not preserve tempo with its progress, mentioned Storm Uru, co-head of the worldwide innovation crew.

Somewhat than specializing in an organization’s price-to-earnings (P/E) ratio to establish its valuation, Liontrust has been wanting on the ‘PEG’ ratio – the P/E ratio divided by the earnings progress fee. The PEG ratio for the median inventory within the S&P 500 index is presently 1.46x. Nvidia’s is considerably decrease at 0.47x.

Liontrust’s International Expertise fund has publicity to all the magnificent seven, however prefers some to others. “After this 12 months’s robust worth returns throughout all seven shares we keep giant weightings in Nvidia, Microsoft and Tesla however solely small positions within the different 4 corporations,” Uru mentioned.

Nvidia has a 90% market share for AI chips and a 10-year lead on its friends, he added. Its graphics processing items (GPU) chips have unlocked accelerated computing, which is 10 occasions sooner than conventional computing, thrice extra power environment friendly, 5 occasions smaller and 90% cheaper.

Microsoft’s Copilot device for software program builders is bettering productiveness by 33-55%, saving builders as much as two hours a day, whereas costing a aggressive $20-55 a month per person. As such, Copilot is offering a return on funding on day one, which is just about unparalleled, Uru mentioned.

Tesla can be far forward of its opponents. “Within the subsequent decade, automobiles are poised to develop into computer systems on wheels. The Tesla Mannequin Y epitomises this transformation. It’s sooner, safer, cheaper, and presents a superior driving expertise in comparison with conventional combustion autos, evidenced by turning into the world’s top-selling automobile within the first quarter of this 12 months,” he defined.

“Over the previous decade, Tesla has carved out a dominant place on this cutting-edge market, with incumbents solely just lately awakening to the magnitude of their shortfall. Tesla’s ascendency stems not simply from its distinctive manufacturing processes and direct-to-consumer distribution technique, but in addition from its modern software program working system, Tesla OS, which is akin to Apple’s iOS and Nvidia’s CUDA.”

Anatomy of the brand new tech cycle

All that mentioned, the brand new tech cycle is a wider story past the magnificent seven. Inside the Liontrust International Expertise fund, 32 totally different corporations have contributed at the very least 50 foundation factors to efficiency 12 months up to now.

Expertise is likely one of the highest high quality sectors now that corporations have emerged from 2022’s recession leaner and extra environment friendly.

“Final 12 months, the inventory costs of quite a few expertise shares declined considerably in tandem with earnings, sometimes falling between 50% and 90% from their current highs. This convergence of an earnings recession and a precipitous drop in inventory costs has prompted administration groups within the expertise sector to shift their focus in the direction of worthwhile progress, transferring away from the earlier technique of pursuing progress at any price,” Uru mentioned.

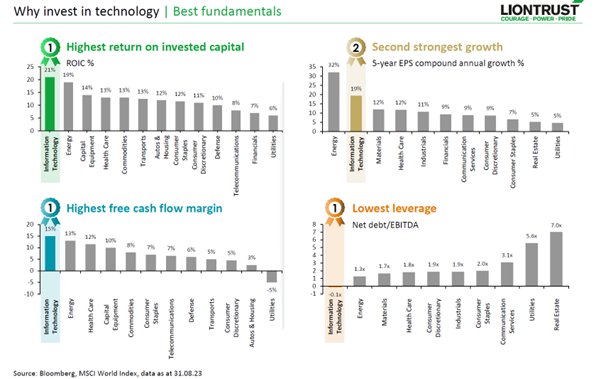

Because the charts beneath present, expertise has the very best return on invested capital of any sector, the very best free money stream margin and the bottom leverage.

Dowey added: “What does a brand new cycle want? A brand new cycle wants a recession to clean off the excesses and get began once more. They haven’t wasted the disaster.”

On condition that the tech sector went by a recession earlier than different industries and reduce prices and headcount, Dowey mentioned tech now has a primary mover benefit, evidenced by efficiency this 12 months, with 60% of shares within the MSCI World Expertise index beating the broader MSCI World.