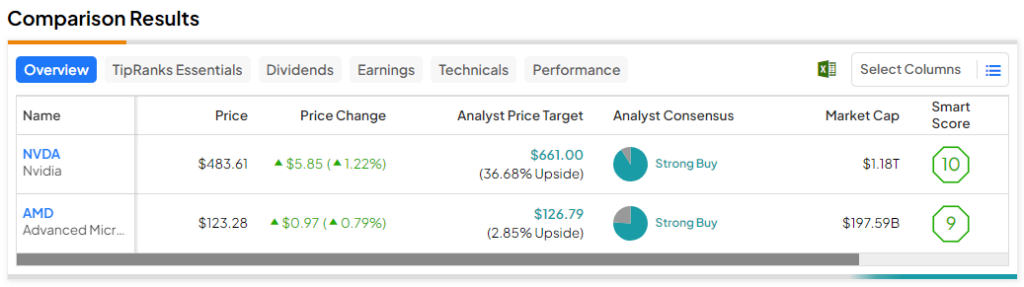

On this piece, I evaluated two chipmaker shares, NVIDIA (NASDAQ:NVDA) and Superior Micro Gadgets (NASDAQ:AMD), utilizing TipRanks’ comparability software to find out which is best. A deeper evaluation suggests a bullish view for NVIDIA and a bearish view for AMD.

NVIDIA develops graphics processing models (GPUs) semiconductors for synthetic intelligence (AI), gaming, inventive design, robotics, and autonomous automobiles. In the meantime, AMD designs processors and associated applied sciences for AI, information facilities, gaming, and business-computing functions.

Shares of NVDA are up 240% year-to-date. In the meantime, AMD inventory has gained 93% year-to-date, together with a 20% return over the past three months.

Regardless of NVIDIA’s a lot increased features this 12 months, it’s buying and selling at a a lot decrease valuation than AMD. We’ll have a look at their price-to-earnings (P/E) ratios to gauge their valuations towards one another and that of their trade. For comparability, the U.S. semiconductor trade is at present buying and selling at a P/E of 46.4 versus its three-year common P/E of 29.9.

NVIDIA (NASDAQ:NVDA)

At a P/E of round 64.3, NVIDIA is buying and selling at a comparatively small premium to its trade (in comparison with AMD’s premium anyway). In truth, the inventory hasn’t been this low cost in a 12 months, and its long-term features additionally counsel a bullish view is likely to be acceptable regardless of the super year-to-date achieve.

On a P/E foundation, NVIDIA hasn’t been this low cost since December 2022. In truth, NVIDIA was buying and selling at a P/E of over 100 simply days in the past — earlier than the final earnings report. In fact, considerably increased earnings ship an organization’s P/E a lot decrease if its inventory worth doesn’t change dramatically.

In NVIDIA’s case, its earnings exploded a lot increased year-over-year that its P/E was lower almost in half after only a small pullback from round $500 a share on November 22 to $489 on November 24. For its third quarter, the corporate reported adjusted earnings of $4.02 per share on $18.1 billion in income versus the consensus estimates of $3.37 per share on $16.2 billion in income.

On a comparative foundation, NVIDIA’s income jumped 206% year-over-year and 34% quarter-over-quarter, whereas its adjusted earnings rose almost sevenfold year-over-year and 49% quarter-over-quarter. The chipmaker’s GAAP (usually accepted accounting rules) earnings rose greater than 13 occasions from a 12 months in the past to $3.71 per share, additionally demonstrating exploding development.

Earlier than that earnings report, NVIDIA shares had soared to a report excessive of round $505 with a P/E of about 120 in November. Usually, I wouldn’t counsel a bullish view of a inventory that has risen a lot, so quick.

Nonetheless, as soon as the market acknowledges its decrease valuation — and recovers from administration’s warning about considerably decrease gross sales to China and different international locations resulting from export restrictions — NVIDIA shares will possible proceed their tear. Regardless of that warning, the chipmaker nonetheless guided for nearly 231% income development to $20 billion within the fourth quarter, so it clearly isn’t all that frightened.

Even when the inventory doesn’t get better dramatically within the close to time period, NVIDIA’s long-term stock-price features of 267% over the past three years, 1,184% over the past 5, and 13,066% over the past 10 present some degree of security over the long run. In truth, I’d use any near-term pullbacks so as to add to the place.

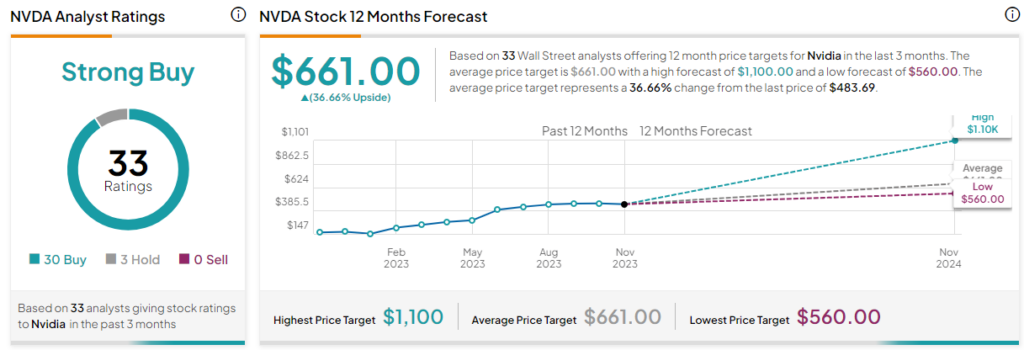

What’s the Worth Goal for NVDA Inventory?

NVIDIA has a Sturdy Purchase consensus ranking primarily based on 30 Buys, three Holds, and 0 Promote scores assigned over the past three months. At $660.39, the typical NVIDIA inventory worth goal implies upside potential of 36.7%.

Superior Micro Gadgets (NASDAQ:AMD)

At a P/E of 1,120, Superior Micro Gadgets has the alternative drawback of NVIDIA. Its valuation has skyrocketed as a result of it’s now barely worthwhile. Nonetheless, the chipmaker actually isn’t going wherever anytime quickly, so it’s solely a matter of time earlier than it bounces again. For now, although, a bearish view appears acceptable, pending a greater entry worth or improved earnings numbers.

Within the third quarter, AMD reported $299 million in GAAP web revenue, though that was an enchancment from web revenue of $66 million a 12 months in the past. On an adjusted foundation, the corporate’s web revenue rose 4% year-over-year to $1.1 billion. AMD additionally reported income of $5.8 billion for the quarter, up from $5.6 billion a 12 months in the past.

Sadly, AMD continues to play catch-up to NVIDIA within the space of synthetic intelligence, though administration did reveal some progress on its final earnings name, asserting enhancements within the firm’s AI software program capabilities by R&D and acquisitions. Administration additionally expects the MI300 information heart chip, which can help AI fashions, to be “the quickest product to ramp to $1 billion in gross sales in AMD historical past.” Briefly, AMD will possible catch as much as NVIDIA in some unspecified time in the future, however we’re not there but.

What’s the Worth Goal for AMD Inventory?

Superior Micro Gadgets has a Sturdy Purchase consensus ranking primarily based on 22 Buys, seven Holds, and 0 Promote scores assigned over the past three months. At $126.79, the typical AMD inventory worth goal implies upside potential of two.9%.

Conclusion: Bullish on NVDA, Bearish on AMD

The battle between NVIDIA and Superior Micro Gadgets has been occurring for years, with one firm pulling out in entrance of the opposite after which the opposite catching up and buying and selling locations. Nonetheless, neither of those firms goes wherever anytime quickly.

Nonetheless, AMD could possibly be enjoying catch-up to NVIDIA on AI for a while, calling for a wait-and-see method. In the meantime, NVIDIA will possible rerate increased as soon as the market digests administration’s warning in regards to the new export restrictions.

Disclosure