Most companies—like most buyers—perceive the worth of diversification. However typically, circumstances could focus worth with one buyer, and even one area. That’s what occurred to chip inventory Nvidia (NASDAQ:NVDA), as an SEC submitting not too long ago revealed that a big a part of its income will be traced again to 1 nation: Singapore. The information had little impression on buyers, as Nvidia was up fractionally in Friday afternoon’s buying and selling, however maybe it ought to be extra of a priority.

The SEC report in query revealed that round 15% of the $2.7 billion Nvidia introduced in final quarter will be traced again to Singapore. Singapore isn’t what anybody would name a giant place, nor widely-known for its technological development. So why does it want so many chips from Nvidia? Jarick Seet with Maybank Securities superior one notion: information facilities. Information facilities and cloud service suppliers have been definitely one choice, together with meeting tasks that required chips so as to full. In the meantime, former Temasek govt Sang Shin famous a lot the identical factor: Singapore is a highly-stable area in Asia, which made it glorious territory for organising information facilities.

Spreading Out into New Chips

Whereas this information isn’t precisely dangerous information for Nvidia, it nonetheless could also be some extent of concern to control. If one thing have been to occur to a area that creates demand enough for 15% of your income, then it’s important to maintain observe of that area and guarantee nothing occurs to harm that demand movement. Granted, Nvidia has labored laborious to diversify, branching out from gaming chips to information facilities and, after all, synthetic intelligence. But it surely’s nonetheless one thing to think about. In spite of everything, latest stories recommend that pricing on the brand new RTX 4090 chip has been on the rise for the previous few months, and now, as one report known as it, has “…formally gone berserk.” Furthermore, provide issues are additionally exhibiting up, and these more and more dear chips are additionally robust to seek out.

Is NVDA a Purchase Proper Now?

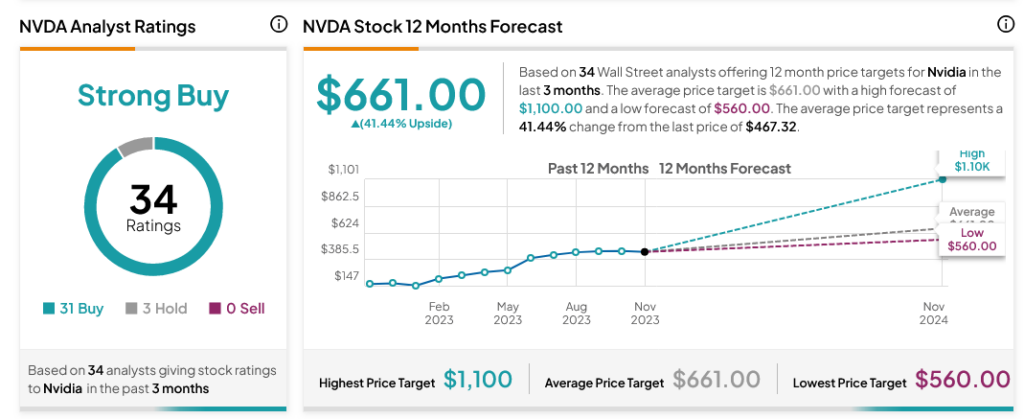

Turning to Wall Avenue, analysts have a Sturdy Purchase consensus ranking on NVDA inventory primarily based on 31 Buys and three Holds assigned previously three months, as indicated by the graphic beneath. After a 177.45% rally in its share value over the previous yr, the common NVDA value goal of $661 per share implies 41.44% upside potential.

Disclosure