December has entered the body, and 2024 is already inside view. In the meantime, the Avenue’s analysts are busy stating the most effective alternatives forward, with every funding financial institution favoring its personal methodology. At Goldman Sachs, the corporate has a delegated class for shares that look significantly interesting; these go on what the banking large calls its Conviction Record, reserved for names that aren’t solely deserving of Purchase rankings however are the cream of the crop.

Because the fairness analysis staff notes, solely names that meet particular standards are chosen to go on the listing. “Our funding course of is targeted on figuring out essentially the most engaging basically pushed idiosyncratic alternatives from inside our buy-rated protection. To that finish, we carefully observe the returns of shares after adjusting for his or her regular relationship with macro/model components,” stated the staff in a latest analysis be aware.

Amongst the shares that Goldman has earmarked as ones boasting excessive conviction credentials proper now are two of the market giants – Nvidia (NASDAQ:NVDA) and Apple (NASDAQ:AAPL). Each have outperformed this 12 months, however the Goldman consultants assume they are going to proceed to take action.

To be truthful, it’s not solely Goldman that fancies these names’ possibilities. Based on the TipRanks database, each are additionally rated as Robust Buys by the analyst consensus. Let’s give them a better look and see what makes them so.

Nvidia

2023 will undoubtedly go down because the 12 months of AI, and among the many names which have used the tech’s assault on the mainstream to totally take benefit, hardly any spring to thoughts extra readily than Nvidia. That’s as a result of the semiconductor large is in a category of its personal within the chip-making course of, offering corporations with the AI chips utilized in Information Facilities to facilitate the advanced computational wants of the tech.

Whereas Nvidia is targeted on completely different verticals starting from auto to crypto and first turned well-known for its gaming-focused GPUs, its Information Middle endeavors have in the end been accountable for unbelievable development. This has been a characteristic of all its calendar 2023 earnings stories, with every one surpassing Avenue estimates and providing a myriad of highlights.

Within the not too long ago reported fiscal third-quarter report, Information Middle was the star of the present once more. The phase notched report revenues of $14.51 billion, representing a 279% year-over-year enhance and a 41% enchancment on the earlier quarter. In whole, income reached $18.12 billion, amounting to a 205.6% enchancment over the identical interval a 12 months in the past. On the similar time, the determine exceeded Avenue expectations by $2.01 billion.

On the backside line, the corporate’s web revenue soared by practically 600% from the prior 12 months’s $1.46 billion to greater than $10 billion, leading to an adj. EPS of $4.02, $0.63 above the analysts’ forecast. Shifting ahead, for FQ4, Nvidia referred to as for gross sales of $20 billion, plus or minus 2%, implying development of 231%, whereas the Avenue was merely anticipating $17.82 billion.

For Goldman Sachs’ Toshiya Hari, Nvidia is the principal ‘shovel provider’ within the AI ‘gold rush.’

“Search for NVDA to keep up its standing because the accelerated computing trade commonplace for the foreseeable future given its aggressive moat and the urgency with which clients are creating and deploying more and more advanced AI fashions,” the 5-star analyst stated. “And, a powerful and broadening demand profile within the Information Middle, plus an bettering provide backdrop ought to help sustained income development by means of CY2024.”

These feedback type the premise for Hari’s Purchase ranking whereas his $625 worth goal makes room for features of 38% within the 12 months forward. (To observe Hari’s observe report, click on right here)

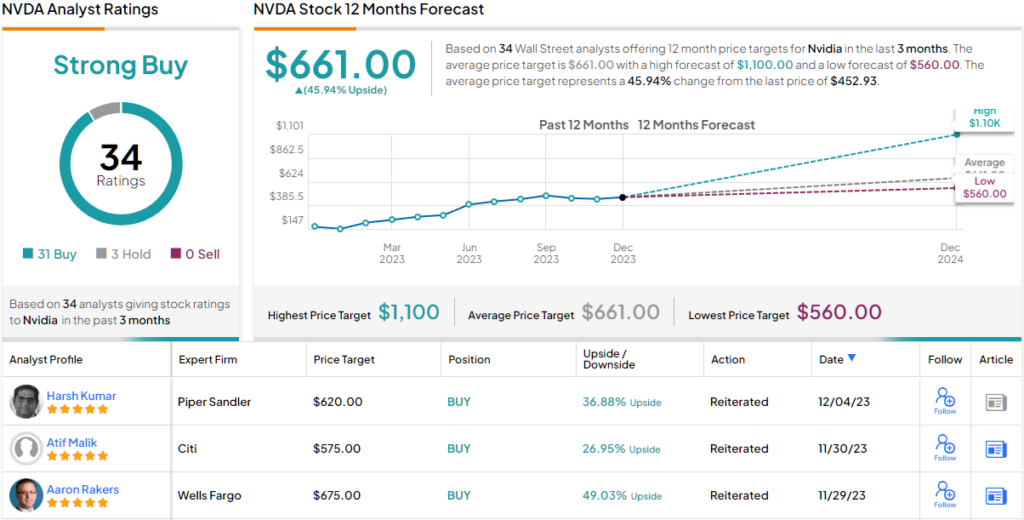

General, there’s broad-based settlement on Wall Avenue that NVDA inventory is shopping for proposition. Of the 34 latest analyst evaluations, 31 are to Purchase towards simply 3 Holds. The $661 common worth goal signifies a possible for ~46% upside from the present buying and selling worth of $467.65. (See Nvidia inventory forecast)

Apple

Nvidia’s success has ensured it now has a spot amongst the unique $1 trillion market cap membership, however it nonetheless has a strategy to go to achieve the virtually $3 trillion valuation boasted by the most important identify on the market. That will be Apple, in fact, the world’s most beneficial firm.

Apple’s rise to the highest has been constructed on a mixture of innovation, magnificence, and performance. The corporate virtually revolutionized our day by day lives and cultural panorama with its groundbreaking merchandise, spearheaded by its ubiquitous flagship, the iPhone. Moreover, its ever-evolving ecosystem regularly explores novel avenues for development, starting from wearables and Apple TV to its extremely profitable Companies enterprise.

That stated, latest instances have proven that development isn’t a given – even at Apple. In its fiscal fourth quarter report (September quarter), regardless of iPhone gross sales and Companies income attaining report ranges, whole income fell by 1% year-over-year to $89.5 million, though that determine did meet Avenue expectations. On the different finish of the size, EPS of $1.46 outpaced the analysts’ forecast by $0.07.

Nonetheless, for the December quarter, Apple recommended that for the fifth quarter in a row, gross sales development will drop once more. On the similar time, there have additionally been worries that Apple’s iPhone gross sales in China may very well be impacted by rising competitors – significantly from Huawei.

These issues haven’t gone unnoticed by Goldman Sachs analyst Michael Ng. Nonetheless, when contemplating the prospects exhibited by different sides of Apple’s enterprise, there’s a lot to recommend the Apple juggernaut will preserve steaming forward.

“Considerations about heightened iPhone competitors present the ‘wall of fear’ for buyers to climb right into a sustained favorable providers enlargement story,” writes Ng. “Search for AAPL to leverage its large and constantly rising put in base, leading to Companies changing into 41% of gross revenue by F2027, from 36% in F2023, serving to to drive a median of 29percentFCF margin and $130bn+ of annual common shareholder returns by means of F2027.”

Apple’s place on the Conviction Record is assured then, with Ng recommending a Purchase ranking, backed by a $227 worth goal. There’s potential upside of 19% from present ranges. (To observe Ng’s observe report, click on right here)

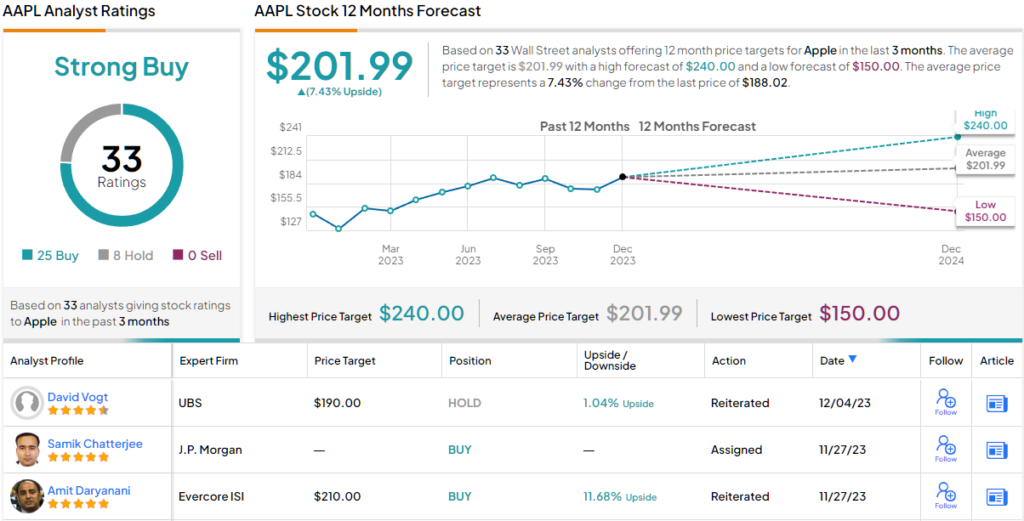

Turning now to the remainder of the Avenue, the place Apple’s Robust Purchase consensus ranking is predicated on a further 24 Buys vs. 8 Holds. That stated, contemplating the massive year-to-date features (up by 53%), the upside seems considerably capped; going by the $201.99 common goal, a 12 months from now, buyers shall be pocketing modest returns of ~7%. (See Apple inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your individual evaluation earlier than making any funding.