Buyers are sometimes guided by the concept of discovering ‘the following large factor’, even when which means shopping for ‘story shares’ with none income, not to mention revenue. However the actuality is that when an organization loses cash annually, for lengthy sufficient, its traders will often take their share of these losses. Loss-making corporations are at all times racing towards time to succeed in monetary sustainability, so traders in these corporations could also be taking over extra danger than they need to.

Regardless of being within the age of tech-stock blue-sky investing, many traders nonetheless undertake a extra conventional technique; shopping for shares in worthwhile corporations like Simpson Manufacturing (NYSE:SSD). Even when this firm is pretty valued by the market, traders would agree that producing constant income will proceed to supply Simpson Manufacturing with the means so as to add long-term worth to shareholders.

See our newest evaluation for Simpson Manufacturing

How Rapidly Is Simpson Manufacturing Growing Earnings Per Share?

The market is a voting machine within the quick time period, however a weighing balance in the long run, so that you’d count on share worth to comply with earnings per share (EPS) outcomes ultimately. So it is smart that skilled traders pay shut consideration to firm EPS when enterprise funding analysis. Shareholders might be blissful to know that Simpson Manufacturing’s EPS has grown 25% annually, compound, over three years. If the corporate can maintain that form of progress, we might count on shareholders to come back away glad.

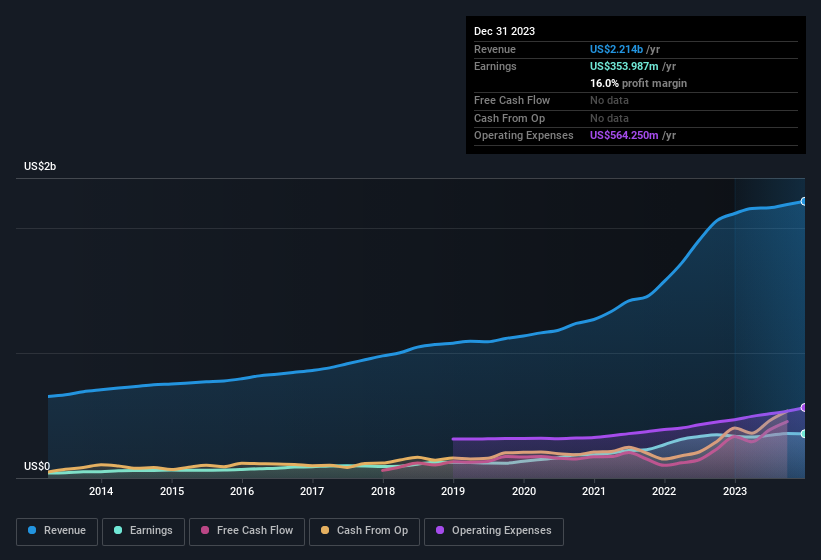

It is usually useful to check out earnings earlier than curiosity and tax (EBIT) margins, in addition to income progress, to get one other tackle the standard of the corporate’s progress. Whereas we be aware Simpson Manufacturing achieved related EBIT margins to final 12 months, income grew by a strong 4.6% to US$2.2b. That is encouraging information for the corporate!

You may check out the corporate’s income and earnings progress development, within the chart beneath. Click on on the chart to see the precise numbers.

After all the knack is to seek out shares which have their finest days sooner or later, not up to now. You might base your opinion on previous efficiency, after all, however you may additionally need to test this interactive graph {of professional} analyst EPS forecasts for Simpson Manufacturing.

Are Simpson Manufacturing Insiders Aligned With All Shareholders?

Owing to the scale of Simpson Manufacturing, we would not count on insiders to carry a major proportion of the corporate. However we do take consolation from the truth that they’re traders within the firm. Certainly, they maintain US$35m price of its inventory. That reveals vital buy-in, and will point out conviction within the enterprise technique. Despite the fact that that is solely about 0.4% of the corporate, it is sufficient cash to point alignment between the leaders of the enterprise and unusual shareholders.

It is good to see that insiders are invested within the firm, however are remuneration ranges cheap? Our fast evaluation into CEO remuneration would appear to point they’re. For corporations with market capitalisations between US$4.0b and US$12b, like Simpson Manufacturing, the median CEO pay is round US$7.8m.

Simpson Manufacturing’s CEO took residence a complete compensation package deal of US$2.8m within the 12 months previous to December 2022. That appears like a modest pay packet, and will trace at a sure respect for the pursuits of shareholders. Whereas the extent of CEO compensation should not be the most important think about how the corporate is considered, modest remuneration is a optimistic, as a result of it means that the board retains shareholder pursuits in thoughts. It can be an indication of a tradition of integrity, in a broader sense.

Ought to You Add Simpson Manufacturing To Your Watchlist?

You may’t deny that Simpson Manufacturing has grown its earnings per share at a really spectacular fee. That is enticing. If you happen to want extra convincing past that EPS progress fee, remember concerning the cheap remuneration and the excessive insider possession. This may occasionally solely be a quick rundown, however the important thing takeaway is that Simpson Manufacturing is price maintaining a tally of. As soon as you’ve got recognized a enterprise you want, the following step is to think about what you suppose it is price. And proper now’s your probability to view our unique discounted cashflow valuation of Simpson Manufacturing. You would possibly profit from giving it a look at the moment.

There’s at all times the potential for doing effectively shopping for shares that are usually not rising earnings and don’t have insiders shopping for shares. However for individuals who take into account these necessary metrics, we encourage you to take a look at corporations that do have these options. You may entry a tailor-made record of corporations which have demonstrated progress backed by current insider purchases.

Please be aware the insider transactions mentioned on this article confer with reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by elementary knowledge. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.