Canalys’ current international wearable band market evaluation forecasts a 2% rise in 2023, totaling to 186 million models. This progress is primarily pushed by a big 22% surge in primary watch shipments in rising markets, notably India. This enhance successfully counterbalances a 9% lower in smartwatch gross sales and a ten% discount in primary band shipments. Trying forward, the wearable band market is poised for a extra substantial uplift, with Canalys anticipating a ten% progress in 2024. This optimistic development is fueled by an anticipated resurgence of curiosity in smartwatches worldwide, with expectations of a 17% enhance of their shipments.

“Primary watches emerged because the standout development in 2023, with the class anticipated to type greater than 40% share of wearable band shipments this yr,” stated Jack Leathem, Analysis Analyst at Canalys. “The success of primary watches might be attributed to an ideal mix of reasonably priced pricing, interesting product designs and a consequent hovering demand in rising markets. These units, which stability fashion and tech at a wallet-friendly value, have emerged as a sensible, short-term various to costlier smartwatches, additionally resulting in a decline within the recognition of the much less useful primary bands. Canalys expects this shift away from primary bands to persist, with shipments projected to fall to 12% by 2027, particularly as primary band market leaders resembling Xiaomi and Google (Fitbit) more and more shift their focus to greater mark-up, wristwatch type elements.”

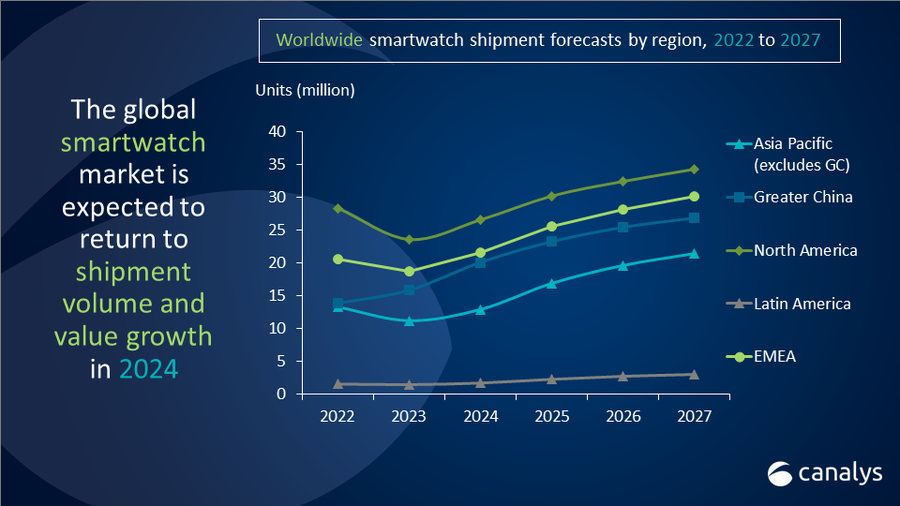

“The smartwatch sector, nonetheless, is poised for a rebound in 2024 with an anticipated cargo of 83 million models. Initially drawn to primary or reasonably priced smartwatches, customers are actually searching for enhanced performance, particularly those that bought units in the course of the COVID-19 pandemic,” acknowledged Leathem. “Distributors goal to spice up cargo revenues by selling superior smartwatches with upcoming {hardware} enhancements, together with vital battery life enhancements and the potential arrival of micro-LED screens on premium units. These enhancements additionally embody novel health and well being capabilities like blood strain monitoring and sleep apnea detection, that are anticipated to grow to be new trade requirements when launched by Apple within the subsequent Tenth-anniversary line of Apple watches. Close to its current ban by the US’s Worldwide Commerce Fee (ITC), prior technology units are anticipated to account for almost all of misplaced shipments within the US market.”

“The worldwide shift to superior smartwatches might be most evident in rising areas, with the Center East and Central and Jap Europe anticipated to see a exceptional 27% and 22% respective enhance in smartwatch shipments in 2024. Customers in these areas are poised to improve from primary watches to smartwatches for the primary time,” famous Cynthia Chen, Analysis Supervisor at Canalys.

Canalys additionally anticipates the rise of cloud-based providers, particularly generative AI, gaining momentum in 2024 after commitments from Zepp Well being and Google in 2023. The rising adoption of compelling AI options by smartwatch distributors indicators progress prospects. “This development of integrating superior AI options into smartwatches is anticipated to open new avenues for market progress,” noticed Chen. “The trade is more and more pivoting towards providing extra refined, AI-driven providers. These embrace personalized suggestions, personalised health regimes and complete efficiency analytics, all powered by AI that mimics human interplay. Producers are optimistic that such improvements won’t solely encourage shoppers to improve their units but in addition enhance service income, improve model loyalty and supply insightful information on consumer habits.”

Chen, nonetheless, cautions in regards to the challenges that include the adoption of generative AI. “As this know-how evolves, it’s important to deal with points associated to information privateness and the accuracy of AI-generated content material, generally known as AI hallucinations.”

“We anticipate these {hardware} and repair upgrades to make a big influence on client demand for smartwatches,” added Chen, highlighting the broader market influence. “Development is forecasted to proceed into 2025 with the share of the smartwatch class rising from 38% in 2024 to 44% in 2025. Concurrently, as extra high-end, premium smartwatches enter the market, Canalys anticipates a considerable enhance within the general worth of shipments.”

|

Worldwide wearable band cargo (forecast and annual progress) |

|||||

|

Class |

2022 |

2023 |

2024 |

Annual |

Annual |

|

Primary band |

40.0 |

35.8 |

33.0 |

-10% |

-8% |

|

Primary watch |

65.4 |

79.7 |

88.5 |

+22% |

+11% |

|

Smartwatch |

77.5 |

70.7 |

82.7 |

-9% |

+17% |

|

Complete |

182.8 |

186.1 |

204.2 |

+2% |

+10% |

|

Observe: percentages could not add as much as 100% resulting from rounding |

|

||||

|

Worldwide wearable band cargo (class share) |

|||||

|

Class |

2022 shipments |

2023 shipments |

2024 |

|

|

|

Primary band |

22% |

19% |

16% |

|

|

|

Primary watch |

36% |

43% |

43% |

|

|

|

Smartwatch |

42% |

38% |

40% |

|

|

|

Complete |

100% |

100% |

100% |

|

|

|

Observe: percentages could not add as much as 100% resulting from rounding |

|

||||

Wearable band class definitions:

Primary bands: wristband with a display screen dimension of lower than 1.6”². The machine has no working system and app help.

Primary watch: wristwatch with a display screen dimension better than 1.6”². The machine is provided with a real-time working system and built-in app help.

Smartwatch: wristwatch with a display screen dimension better than 0.6”². The machine is provided with a complicated working system that gives third-party app help.

For extra info, please contact:

Jack Leathem: jack_leathem@canalys.com

Cynthia Chen: cynthia_chen@canalys.com

About Wearable Evaluation

Canalys’ Wearable Band Evaluation service supplies qualitative and quantitative insights into the wearable band market and addresses the areas the place distributors can enhance. Our greatest-in-class service guides distributors and companions to make the fitting choices on worth propositions, select the fitting channel companions and improve go-to-market methods to have interaction in several markets worldwide. The information has detailed splits, monitoring an inventory of fifty+ options round connectivity, elements, sensors, chipsets and plenty of different completely different classes. Mannequin-level info is accessible for 30+ key markets.

About Canalys

Canalys is an unbiased analyst firm that strives to information purchasers on the way forward for the know-how trade and to assume past the enterprise fashions of the previous. We ship sensible market insights to IT, channel and repair supplier professionals world wide. We stake our status on the standard of our information, our modern use of know-how and our excessive stage of customer support.

Receiving updates

To obtain media alerts instantly, or for extra details about our occasions, providers or customized analysis and consulting capabilities, please contact us. Alternatively, you’ll be able to e mail press@canalys.com.

Please click on right here to unsubscribe

Copyright © Canalys. All rights reserved.