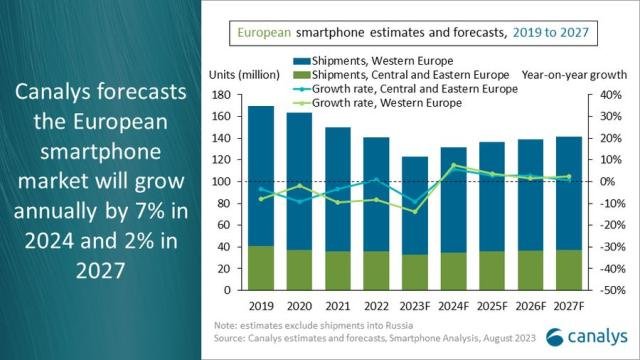

In a current report, analysis agency Canalys has forecasted that the European smartphone market, excluding Russia, will witness a resurgence in 2024, with shipments set to extend by 7 % to succeed in 132 million items.

Whereas the market faces challenges all through 2023, together with constraints on shipments as a result of prolonged machine lifetimes, rising competitors from secondhand markets, and excessive channel stock ranges, situations are anticipated to enhance.

Runar Bjorhovde, an Analyst at Canalys, famous that regardless of the continuing difficulties, indicators of optimism have emerged. Falling inflation and improved stock ranges are setting the stage for market development to return in 2024. A number of elements will contribute to this restoration, together with an upcoming refresh cycle and easing financial pressures.

Bjørhovde identified that Central and Japanese Europe, Italy, Spain, and Portugal current important short-term alternatives for smartphone distributors as a result of shorter refresh cycles and a optimistic angle amongst retailers in direction of new choices and rising manufacturers.

Moreover, markets that predominantly function smartphones within the US$800+ phase, equivalent to Germany, France, and the Nordics, are anticipated to start out rising within the second half of 2024 as financial pressures subside. These markets, regardless of experiencing the biggest declines within the second quarter, have substantial put in bases that may drive a resurgence in shipments as gadgets attain the tip of their lifecycles and require substitute, with expectations of a rebound in the course of the procuring vacation season in 2024.

To strengthen their positions for future development, a number of distributors are increasing their attain. Samsung and Google, for instance, are investing additional within the B2B phase to match Apple’s Distributor Companion Program. Motorola, then again, is prioritizing development within the shopper phase and investing in advertising growth funds for the channel.

Bjørhovde emphasised that the seller panorama in Europe is shrinking, making it important for distributors to supply sturdy omnichannel gross sales help throughout a large channel. This have to be mixed with product portfolios that align with native necessities when it comes to pricing and specs.

Wanting on the long-term outlook, Canalys anticipates reasonable cyclical development within the European smartphone market, which is able to problem present income fashions for distributors and the channel. Components equivalent to longer machine lifetimes, regulatory efforts to cut back new machine volumes, and rising demand for used and refurbished gadgets would require distributors to determine new income alternatives. This will likely contain promoting unique spare components, supporting the channel in driving machine trade-ins, and providing vendor-refurbished gadgets.

Finally, distributors that show resilience within the present market surroundings and adapt rapidly to new laws are prone to set up themselves as sturdy long-term companions for the channel, in keeping with Canalys. The year-on-year development price within the European smartphone market is projected to succeed in 7 % in 2024 after which steadily gradual to 2 % by 2027, with volumes finally recovering to 2022 ranges.