The story for Tesla (NASDAQ:TSLA) this 12 months has been about rising gross sales towards decrease margins. That’s as a result of with the intention to stimulate waning demand, the EV chief has enacted a collection of worth cuts on its fashions.

The trouble has had the meant impact; Tesla has certainly been promoting extra vehicles. But, it has come at a worth. The aspect impact of decrease costs has resulted in a decrease margin profile. And that, says Needham analyst Chris Pierce, requires taking a look at Tesla from a unique angle.

“TSLA’s valuation implies continued share positive aspects, mixed with a return to greater margins,” Pierce explains. “Sadly, we view these as opposing forces, with TSLA competing on worth to drive items and acquire share, making it troublesome to believe in consensus’ margin trajectory.”

Particularly, whereas consensus fashions a 200bps improve for 2024 gross sales gross margin ex reg credit, Pierce now sees that as flat year-over-year in comparison with up ~100bps beforehand.

Whereas Pierce factors out that Tesla has been a winner within the ICE to EV transition, now, with the corporate utilizing discounting as a lever, its “strategic differentiation vs mass-market OEMs has compressed.”

Tesla’s newest working margins nonetheless maintained a slight benefit in comparison with conventional ICE opponents, however Pierce believes this benefit may lower additional. This expectation is predicated on the idea that the margins of legacy friends are “at present inflated by eroding pricing energy as new car inventories develop.”

“If TSLA is exhibiting a willingness to compete at or close to friends margin ranges, and peer margins transfer decrease,” opines the analyst, “we battle to see TSLA margins transferring appreciably greater.”

Thus, Pierce sees Tesla as on a path in the direction of turning into a mass-market OEM sooner in comparison with prior expectations, and given the potential long term margin profile, he views that as “multiple-limiting.”

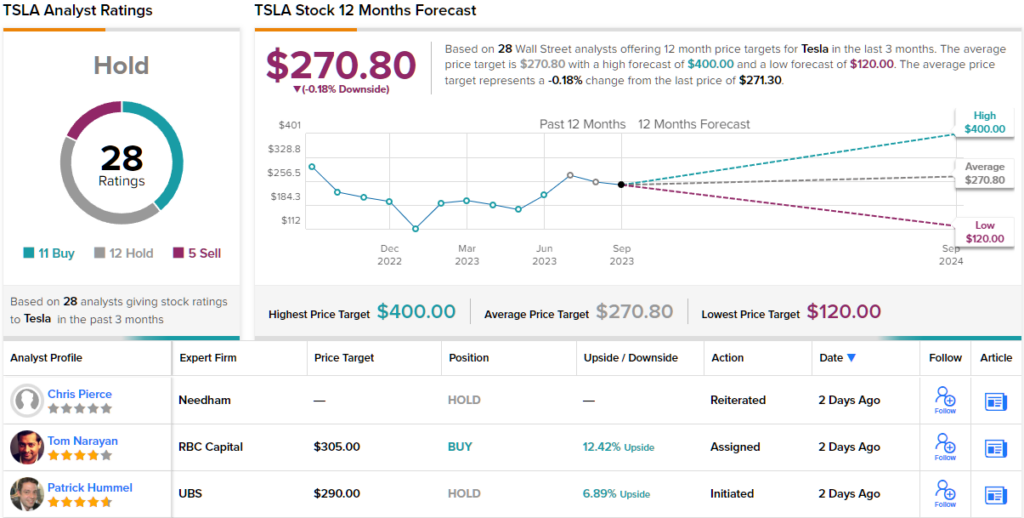

As such, Pierce stays on the sidelines with a Maintain (i.e., Impartial) score and no particular worth goal in thoughts. (To look at Pierce’s monitor document, click on right here)

On steadiness, TSLA shares additionally command a Maintain consensus score from the Avenue’s analysts, based mostly on a mixture of 12 Buys and Holds, every, plus 5 Sells. The $272.50 common goal implies shares are at present altering arms for nearly the appropriate worth. (See Tesla inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.