Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Nvidia’s declare that its enterprise can sidestep the consequences of US controls on the export of semiconductors to China is about to be examined when it publishes quarterly earnings on Tuesday.

Buyers have, for now, dismissed fears that Nvidia will endure after the US tightened restrictions on gross sales to China of superior processors which can be appropriate for creating massive synthetic intelligence techniques. The chipmaker has mentioned the controls wouldn’t have a “near-term significant affect” on its enterprise.

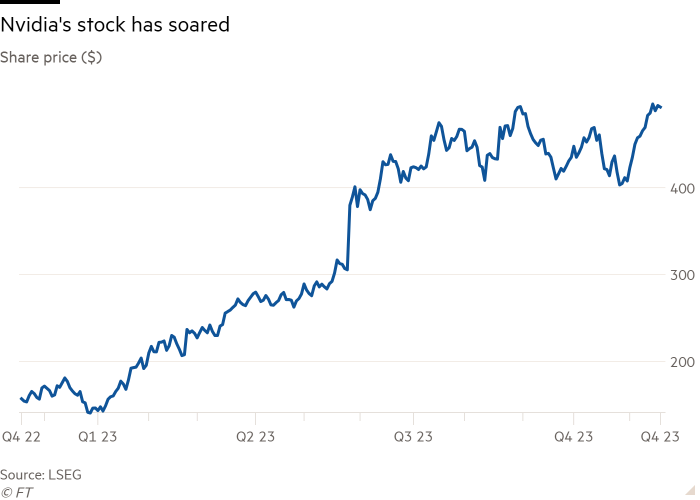

For the reason that Biden administration’s announcement in mid-October, Nvidia’s inventory market valuation has misplaced after which regained about $200bn — equal to your entire market capitalisation of Intel — hitting an all-time excessive final week that valued the corporate at $1.2tn.

Analysts at Morgan Stanley mentioned in a analysis be aware final week that the affect of the China restrictions was “probably the most requested query into earnings” amongst Nvidia traders.

China accounts for as much as 25 per cent of gross sales in Nvidia’s information centre enterprise however the firm confidently asserted final month that it didn’t but anticipate vital fallout from the brand new US guidelines.

“Given the energy of demand for our merchandise worldwide, we don’t anticipate that the extra restrictions can have a near-term significant affect on our monetary outcomes,” it mentioned.

The outcomes to be introduced on Tuesday cowl the three months to the tip of October, so there’s prone to be little within the earnings themselves reflecting the change within the guidelines. However traders will look carefully on the ahead steerage.

Nvidia has tried to skirt US restrictions on its chip gross sales in China with new processors that work across the efficiency restrictions.

Earlier this yr it launched a modified model of its flagship H100 processor for Chinese language clients, known as H800, following the preliminary US restrictions introduced in October 2022. Then, this month, the Monetary Occasions reported that Nvidia had once more tailored its merchandise, with a brand new product for China known as H20.

The corporate has not formally introduced the H20 however circulated its specs to potential clients in China. The small print have left observers conflicted about whether or not Nvidia has been capable of accommodate US necessities whereas additionally satisfying Chinese language clients’ demand for AI chips.

Analysts and senior managers at two Chinese language cloud computing suppliers mentioned these particulars urged the H20 could not present sufficient computing energy to effectively practice AI techniques equal to OpenAI’s newest mannequin, GPT-4. The chips wouldn’t permit Chinese language firms to stay aggressive with their US counterparts, these individuals mentioned — a vital objective of the Biden administration.

Executives at Tencent and Alibaba urged final week throughout their quarterly earnings calls that the Chinese language tech teams could not have the ability to depend on new chips from Nvidia to coach their AI fashions. Each mentioned they deliberate to extend their deal with home alternate options to Nvidia, with Huawei seen because the almost definitely beneficiary.

Eddie Yongming Wu, Alibaba chief government, mentioned he anticipated to see “a number of totally different chips getting used [from] a number of totally different suppliers, assembly demand for AI computing energy within the China market”.

Charlie Chai, a Shanghai-based analyst at 86Research, mentioned it was “primarily troublesome” to make use of the H20 for coaching massive AI fashions, restricted by a efficiency cap on a single chip.

Nvidia has lengthy argued in opposition to US controls on the grounds that holding again American firms in China would solely gasoline the advance of native chipmakers.

Analysts and business insiders say that it could take years for Chinese language tech firms to adapt their techniques to make use of home chips as a substitute of Nvidia’s. Nonetheless, this course of has been accelerated by the US authorities’s tightening of export controls.

“Now everyone seems to be compelled to adapt the Huawei chips and software program,” Chai mentioned, including that Nvidia “could have underestimated Huawei’s functionality”.

But not each analyst is satisfied that Nvidia’s enterprise will endure, a minimum of within the subsequent yr.

Morgan Stanley mentioned it was “considerably stunned to report that there’s minimal affect near-term” from the brand new controls, partly as a result of — as Nvidia itself indicated — demand for its AI processors was to this point forward of provide in different components of the world.

Dylan Patel, chief analyst at chip consultancy SemiAnalysis, mentioned that regardless of Chinese language firms’ public feedback, that they had ordered a “very vital quantity” of H20 chips, which regardless of its limitations had been nonetheless extra succesful than the Nvidia A100 chips that OpenAI used to coach earlier generations of GPT. He estimated that Chinese language clients would spend about $15bn on H20-based techniques subsequent yr.

“Lots of of hundreds of H20s are going to be manufactured and bought,” Patel mentioned. “It’s not optimum however it’s the finest chip [for AI development] that China should buy.”

Nvidia declined to remark.