Chip big Nvidia (NASDAQ:NVDA) as soon as once more delivered stellar monetary numbers. Nonetheless, its stable Q3 earnings and sturdy This fall outlook didn’t raise its share value. This prompts us to ask whether or not to take a position or not in Nvidia inventory. Based mostly on analysts’ consensus scores, NVDA inventory is a Purchase. Additional, Nvidia sports activities a “Excellent 10” Sensible Rating (study extra about Sensible Rating right here) on TipRanks, suggesting the next chance of outperforming the broader markets. All these present that buyers ought to put money into NVDA inventory.

As analysts and TipRanks’ Sensible Rating favor NVDA, let’s delve deeper to know why it’s a Purchase close to the present ranges.

Elements Impacting Nvidia Inventory

Whereas there could possibly be a number of explanation why buyers didn’t present enthusiasm for Nvidia’s stable Q3 efficiency, probably the most notable ones are apprehensions associated to China and issues in regards to the firm’s valuation. Nvidia emphasised that gross sales to China and different impacted areas, which are actually topic to licensing necessities, have persistently represented round 20% to 25% of Information Middle income in latest quarters. The corporate anticipates a considerable decline in gross sales to those locations within the fourth quarter.

Nonetheless, Nvidia’s administration shortly identified that the decline in gross sales in these areas will probably be greater than offset by stable development within the different areas. This implies buyers shouldn’t fret over challenges associated to China.

Whereas Nvidia is poised to profit from huge demand for AI (Synthetic Intelligence) and its dominant place within the AI sector, its inventory continues to commerce at a premium a number of than its friends. Nvidia inventory is buying and selling at ahead price-to-sales a number of of twenty-two.39, a lot increased than Superior Micro Gadgets (NASDAQ:AMD) and Intel’s (NASDAQ:INTC) valuation a number of of 8.49 and three.42. Nonetheless, NVDA’s premium valuation is justified on account of its management in AI and stellar development. Additional, Nvidia’s income from the Information Middle section alone is increased than the general income of Intel and AMD. With this backdrop, let’s take a look at the Avenue’s projection for NVDA inventory.

Is Nvidia Anticipated to Go Up?

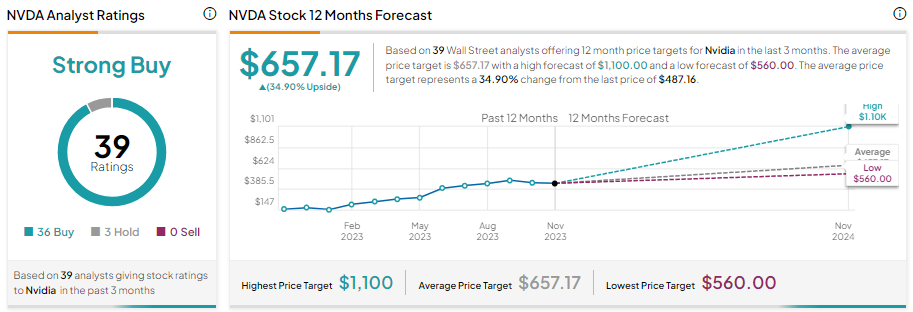

Wall Avenue analysts’ common value goal means that Nvidia inventory is predicted to go up. The inventory has already gained over 233% year-to-date. Furthermore, analysts’ common value goal of $657.17 implies 34.90% upside potential from present ranges.

Additional, with 36 Purchase and three Maintain suggestions, Nvidia inventory has a Robust Purchase consensus ranking on TipRanks.

Backside Line

With its industry-leading AI platform and deal with accelerating its product growth cycle, Nvidia is well-positioned to ship sturdy monetary numbers within the coming quarters. The corporate expects its This fall income to succeed in almost $20 billion, in comparison with $6.05 billion within the prior-year quarter. Furthermore, its enterprise momentum will possible be sustained pushed by stable demand for AI. These positives are mirrored in analysts’ Robust Purchase consensus ranking.

Disclosure