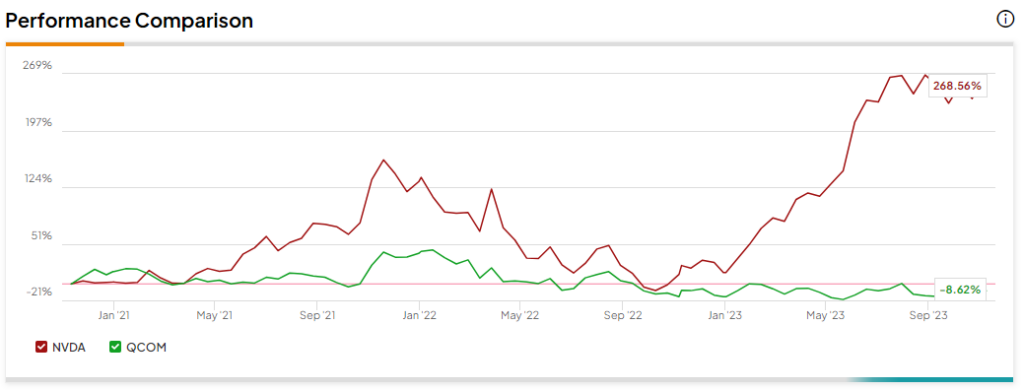

Nvidia (NASDAQ:NVDA) and Qualcomm (NASDAQ:QCOM) are semiconductor kingpins which have rather a lot to achieve from the generative synthetic intelligence (AI) race. AI is not the one vital development driver, although, as each corporations look to make an enormous splash into the CPU (central processing unit) chip waters, utilizing none aside from Arm’s (NASDAQ:ARM) know-how. For these unfamiliar with Arm, it is a agency that licenses its structure to different firms looking for to create their very own customized chips.

As Nvidia and Qualcomm rip a web page out of the playbook of Apple (NASDAQ:AAPL) and its Arm-based Apple Silicon technique, it can definitely be attention-grabbing to see how the following technology of Arm CPUs stack up in opposition to each other. Rising competitors within the area is an enormous win for shoppers however one other potential hit to the chin for Intel (NASDAQ:INTC), the previous CPU big that is actually suffered a fall from grace.

Nvidia and Qualcomm each have rather a lot to achieve relative to what they stand to lose as they be part of the arms race. And for that cause, I am bullish on each corporations as they prepared their CPUs for launch.

Qualcomm and Nvidia Might Achieve on the Expense of Intel

Up forward, Qualcomm’s Snapdragon X Elite (together with its CPU core know-how, Oryon) is slated to be launched in the course of 2024. For now, Intel would not appear to view Qualcomm, Nvidia, or every other Arm CPU combatant as making a dent within the laptop computer market.

Given Apple’s success with Apple Silicon and its newest M3 line of chips, I feel it is fairly worrisome for Intel to downplay the credible risk of Arm CPUs. Certainly, Intel doesn’t have a lot room to be complacent because the rising development of extra corporations making their very own customized silicon (with the assistance of Arm) continues to take off.

Apple has been main the cost in the case of customized silicon. And the per-watt efficiency leap from Intel-based Macs has been completely outstanding. Actually, Apple actually inspired its Intel-based Mac customers to make the leap to Apple Silicon in its “Scary Quick” occasion.

Following in Apple’s Footsteps

Undoubtedly, the benchmarks for the M3, M3 Professional, and M3 Max chips had been most spectacular when in comparison with the unique M1 line of chips. In comparison with the M2 line, efficiency enhancements appeared relatively tame. That mentioned, on condition that many Mac customers are nonetheless on Intel-powered Macs, the actual alternative might lie in nudging pre-Apple Silicon customers to make the leap. Given the ability of Apple’s ecosystem, it is not exhausting to think about many Apple followers shifting to Apple Silicon and away from Intel, maybe for good.

As Qualcomm and Nvidia prepared their very own Arm choices for launch over the medium time period, there is a good probability that each corporations may add stress on the PC aspect.

To not low cost the turnaround efforts happening at Intel, however issues usually are not trying good for Intel within the slightest as we transfer into the following technology of Arm-based CPUs. Maybe the one factor scarier than Apple (and its Scary Quick M3 chip, which was unveiled the day earlier than Halloween 2023) is Nvidia. The GPU kingpin is among the hottest Magnificent Seven gamers in recent times. And if it units sights on Arm CPUs, I might not wager in opposition to the agency because it appears to get in on the motion.

Nvidia acknowledged the ability of Arm early within the recreation, with its failed try to accumulate it round three years in the past in a proposed deal value $40 billion. Although Nvidia’s Arm acquisition hopes had been referred to as off in a rush, the transfer would not seem like stopping Nvidia from pursuing its grand Arm ambitions.

Furthermore, whereas the reduction rally in INTC inventory has been going sturdy for round a yr, I might not be stunned if it is reduce quick by the hands of Qualcomm or Nvidia.

Is QCOM Inventory a Purchase, In keeping with Analysts?

On TipRanks, QCOM inventory is available in as a Reasonable Purchase. Out of 20 analyst scores, there are 13 Buys, six Holds, and one Promote ranking. The common Qualcomm inventory worth goal is $135.59, implying upside potential of 9.7%. Analyst worth targets vary from a low of $100.00 per share to a excessive of $160.00 per share.

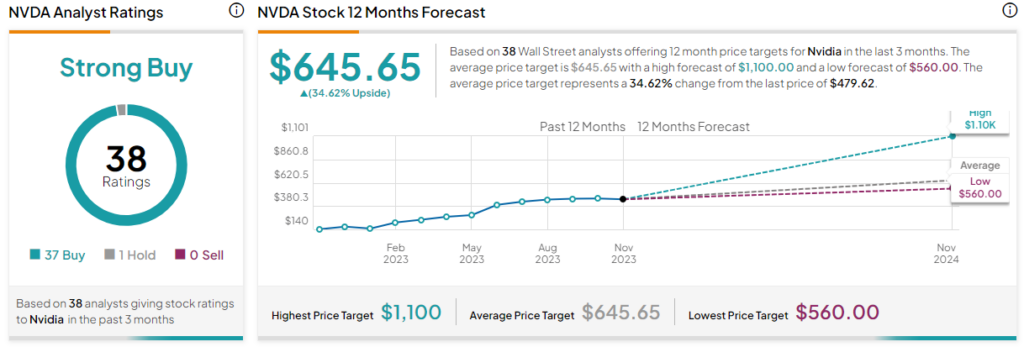

Is NVDA Inventory a Purchase, In keeping with Analysts?

In the meantime, NVDA inventory is available in as a Sturdy Purchase on TipRanks. Out of 38 analyst scores, there are 37 Buys and one Maintain advice. The common Nvidia inventory worth goal is $645.65, implying upside potential of 34.6%. Analyst worth targets vary from a low of $560.00 per share to a excessive of $1,100 per share.

On the excessive finish, Rosenblatt Securities sees NVDA inventory greater than doubling (129% upside) from present ranges to $1,100.00 per share. That is a Avenue-high goal and one which is probably not so out of sight if Nvidia can repeat the magic with its Arm-based CPU because it continues sprinting with the AI ball.

The Backside Line

Entering into the Arm CPU scene has the potential to be profitable — simply ask Apple. Even when the choices of Qualcomm or Nvidia fail to reside as much as the hype, it definitely looks as if Arm is permitting extra corporations to problem Intel. The one query is whether or not Intel will be capable to maintain its personal as extra punches come its means.

Disclosure

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

Source link