David Paul Morris/Getty Photos Information

“This Is the Firm’s iPhone Second”

On Might 27, 2023, Nvidia Company (NASDAQ:NVDA) CEO Jensen Huang declared, “This Is the Firm’s iPhone Second.” In lower than 4 months, shares have surged one other 58%.

Many traders had been enthused by the comparability to Apple’s (AAPL) success underneath Steve Jobs. Nevertheless, it is essential to unpack what precisely Huang meant by Nvidia’s “iPhone second” and why it issues.

The iPhone represented a breakthrough gadget that catalyzed a smartphone revolution. Its multi-touch interface and modern {hardware} design made current merchandise immediately out of date. Huang’s analogy suggests Nvidia is present process a equally transformative shift that can redefine its market place. Nvidia’s GPU computing parallelism disrupted legacy CPUs a lot because the iPhone revolutionized telephones.

Warren Buffett’s Funding Technique

The iPhone launched in 2007, but Warren Buffett did not spend money on Apple till 2016 with the iPhone 7. Why the delay? Solely by 2016 did Tim Prepare dinner reveal providers had been ~10% of revenues with the potential to succeed in $100 billion. We consider that: (1) the iPhone’s iOS platform, which reworked the smartphone panorama, gives a broader vary of functions than the iPhone’s preliminary attraction of modern design and contact interface. (2) Buffett avoids firms with out sustainable money flows. The high-margin iPhone secured iOS’ pricing energy and sustainable revenues by locking in customers. Although the {hardware} commanded preliminary hype, Buffett waited practically a decade for proof of recurring monetization earlier than investing, as soon as the providers ecosystem was quantified.

Equally, traders should not take Nvidia’s iPhone second as blind religion. The analogy solely holds weight if Huang’s declared inflection catalyzes a permanent platform like iOS with recurring revenues, pricing energy, and aggressive moats. Nevertheless, regardless of selling its cloud and different providers like Omniverse as potential software program ecosystems, Nvidia has but to display sustainable recurring revenues.

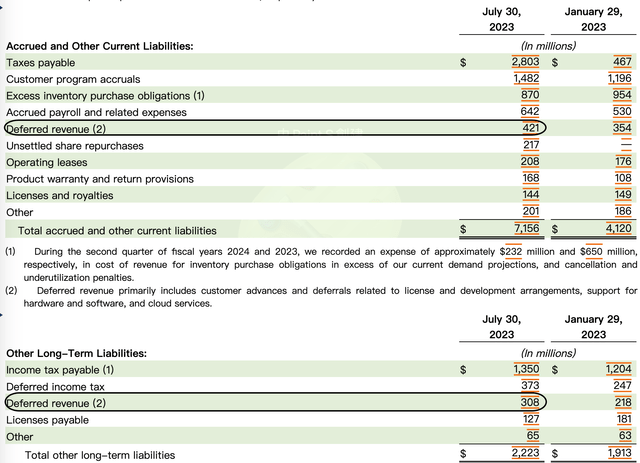

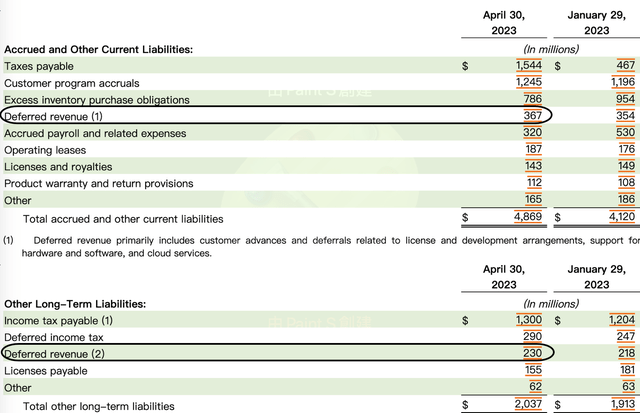

Analyzing Deferred Revenues as an Indicator

In contrast to Apple’s clear providers disclosures, Nvidia doesn’t get away product vs. service income. Nevertheless, deferred income progress offers some perception into providers and platform traction as they measured the multi-year service contracts.

NVIDIA AI Cloud Service Choices

We entered and will proceed to enter into multi-year cloud service agreements to help these choices and our analysis and improvement actions.

Surprisingly, its deferred revenues on the finish of Q2 stood at simply $735 million, marking a 23% sequential development from Q1’s $597 million, or 28%. This does not align with its sequential income development of 87% or its year-over-year development of 101%.

NVDA

NVDA

Nvidia’s Software program-{Hardware} Bundling Technique

We consider this example arises from Nvidia’s technique of bundling its software program with its {hardware} techniques. This method won’t align with the most effective pursuits of its prospects. As reported by Reuters, AWS thought-about partnering with Superior Micro Gadgets, Inc. (AMD) and opted to not collaborate with Nvidia on the DGX cloud providing. This choice might stem from potential conflicts of curiosity, given Nvidia’s aspirations to dominate the information middle area. The Data highlighted that Nvidia’s ambitions would possibly result in capturing a bigger share of earnings within the worth chain. Regardless of the underlying causes, there is no strong proof at current to counsel that Nvidia has strong service contracts in place to make sure a constant money movement.

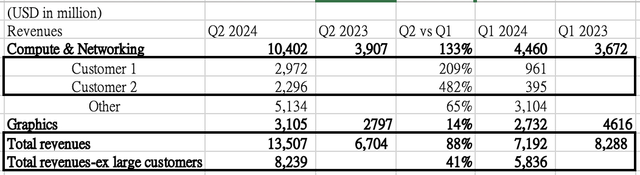

The Significance of Buyer Focus

Moreover, when Buffett invested in 2016, Apple had bought over 1 billion iPhones, evidencing broad mainstream demand past simply high-end shoppers. This worldwide person base gave Apple regular bargaining energy.

In distinction, Nvidia’s prime two largest prospects accounted for 17% and 22% of its This fall 2023 income, respectively. Probably Google (GOOG) and Microsoft (MSFT), this excessive buyer focus suggests a narrower, extra concentrated purchaser base than Apple’s on the time of Buffett’s funding.

One information middle distributor buyer represented roughly 17% and 13% of complete income for the second quarter and first half of fiscal 12 months 2024, respectively, and was attributable to the Compute & Networking section.

A big CSP, which primarily purchases not directly by means of a number of system integrators and distributors, is estimated to symbolize roughly 22% and 19% of complete income for the second quarter and first half of fiscal 12 months 2024.

Excluding the highest two prospects, Nvidia’s sequential income development would have been a still-strong 41% versus the reported 88% together with them. This highlights Nvidia’s reliance on a concentrated variety of heavy AI-spending tech giants, doubtless Microsoft and Google.

NVDA, LEL

The Position of AI in Computing

These mega-customers accounted for $5.1 billion in gross sales final quarter, turbocharging general outcomes. It is debatable what number of different prospects can spend at an analogous scale on accelerated computing. Whereas AI is a fast-growing discipline, most firms have far smaller information processing wants than Massive Tech.

This mirrors debates through the PC revolution – PCs vastly expanded particular person capabilities however initially confronted questions on mainstream necessity. Nevertheless, it is important to think about that PCs empowered people to carry out duties they could not when PCs’ fundamental competitors was human effort.

In distinction, Nvidia competes towards various silicon-like CPUs and AMD GPUs. Whereas its parallel computing excels at AI, it stays to be seen if this functionality is as indispensable for many companies as PCs had been for particular person productiveness versus human effort.

An analogous instance will be drawn with bank cards when digital wallets emerged. They turned extra profitable in nations apart from the U.S., like China, the EU, and different rising nations the place a widespread bank card cost community did not exist. Subsequently, we’re skeptical about Jensen Huang’s declare that CPUs are outdated and that GPUs will take over, as there are numerous duties nonetheless carried out effectively by CPUs at decrease prices. Buyers ought to tread fastidiously, particularly since Nvidia’s huge market capitalization is predicated on this daring assertion.

DCF Evaluation and Nvidia’s Formidable TAM Projection

We constructed a reduced money movement, or DCF, evaluation based mostly on Jensen Huang’s assertion that the cloud market is at present $1 trillion, although different estimates peg it round $500 billion. Adopting his determine and assuming a 15% CAGR over 10 years yields a $4 trillion complete addressable market (“TAM”).

Even when we assume Nvidia disrupts 30% of this market, maintains 30% free money movement margins, and hits goal market share in a decade, it might require 43% income CAGR for Nvidia to succeed in $1.2 trillion in gross sales by 2033.

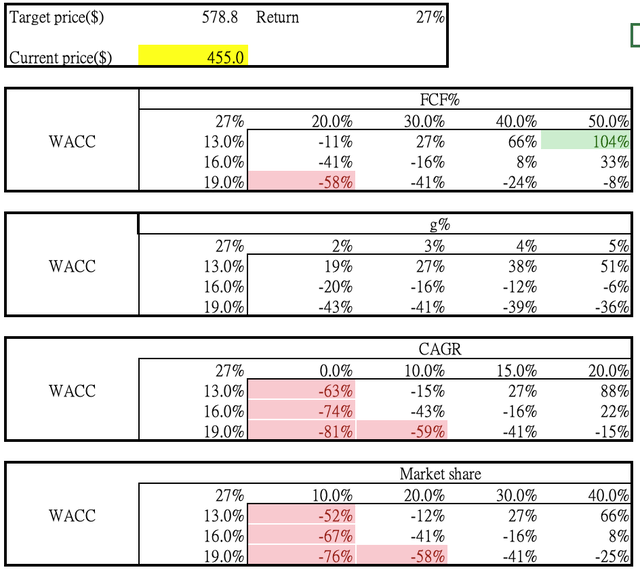

Discounting again at a 13% WACC, this offers us a valuation of the market cap of $1.4 trillion, or $578 per share – a 27% upside from present ranges.

Sensitivity evaluation (LEL)

Sensitivity Evaluation and Potential Draw back Dangers

Nevertheless, this upside depends on Nvidia each sustaining its appreciable edge in accelerated computing and the market scaling to $4 trillion as projected. Until Huang’s lofty TAM determine proves correct, our DCF could embed overly optimistic assumptions.

Past the Cloud Sector

The outcomes from the DCF mannequin are intriguing, because it solely assumes Nvidia’s disruption within the cloud sector. With the above stress check, the mannequin presents an interesting worth, and that is with out contemplating if Nvidia disrupts one or two different sectors similar to auto and gaming. Its valuation might simply surpass $4 trillion. Nevertheless, since Nvidia’s development is primarily noticed in information facilities, we consider the present market sentiment is affordable. It is based mostly on Jensen’s bold imaginative and prescient, and given his monitor document of delivering outcomes, he has earned credibility.

The important thing draw back dangers are decrease trade development and Nvidia underachieving the 30% share assumed. If the cloud market would not maintain 10%+ CAGR and attain $4 trillion, or Nvidia fails to seize its projected share, the draw back might exceed 50% based mostly on our sensitivity testing. Contemplating simply the cloud, the risk-reward is unappealing based mostly on the expansion charges embedded in our DCF.

Autonomous Driving

Some would possibly spotlight the potential use case in autonomous driving. Nevertheless, it is important to notice that, strictly talking, the coaching of autonomous driving fashions continues to be a part of the information processing narrative. Furthermore, it won’t be indispensable for each automotive producer. Take Tesla (TSLA) for instance: whereas it has bought from Nvidia, it additionally developed its personal Dojo chip tailor-made for autonomous driving. This attitude is additional strengthened by the truth that Nvidia did not report vital development within the automotive sector in Q2.

Conclusion

General, whereas Nvidia maintains a robust aggressive place at present, excessive buyer focus and minimal providers income pose issues. We just like the iOS moments significantly better than the iPhone moments. As well as, its parallel computing excels in information processing, however the addressable market could also be narrower than anticipated.

We stay impartial absent proof factors like: (1) significant high-margin providers income; and (2) validated use-cases past concentrated information middle/supercomputer demand. Whereas the potential exists to increase Nvidia’s disruptive attain, exercising warning till market uptake broadens appears prudent given development expectations embedded in its valuation.