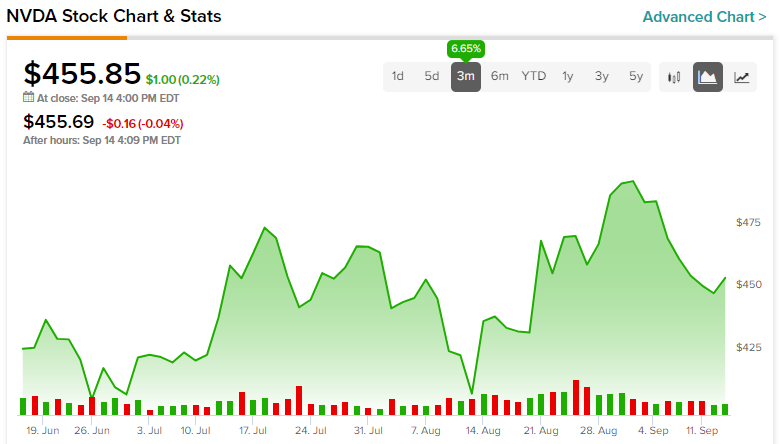

Once I beneficial Nvidia (NASDAQ:NVDA) inventory final November, the semiconductor agency was poised to learn enormously from the upcoming synthetic intelligence (AI) growth. Since then, it has risen from $195 to over $455. So, the urgent query is, has NVDA reached its peak, or is there nonetheless room for upside this 12 months? I imagine NVDA represents a long-term development alternative that’s flourishing amid the AI growth. Consequently, I understand the current decline from its all-time excessive of ~$502 as a shopping for alternative.

NVDA’s Marvellous Q2 Beat and Promising Q3 Outlook

On August 23, NVDA reported excellent Q2 outcomes. Revenues grew 101% year-over-year to $13.5 billion, considerably beating the corporate’s personal income steerage of $11 billion offered within the previous quarter.

GAAP EPS exhibited extraordinary development as effectively, surging by 854% year-over-year and 202% sequentially to achieve $2.48. Much more noteworthy is the exceptional enchancment in its gross margin, because it soared to a formidable 70.1% in comparison with 43.5% within the prior-year interval and 64.6% within the earlier quarter.

On prime of that, the corporate outlined a promising outlook for the longer term, surpassing analysts’ expectations. Notably, for Fiscal Q3 2024, the corporate expects revenues to develop to $16 billion, a lot greater than analysts’ expectations of $12.5 billion. Extra positively, its adjusted gross margin is predicted to hover round 72.5%.

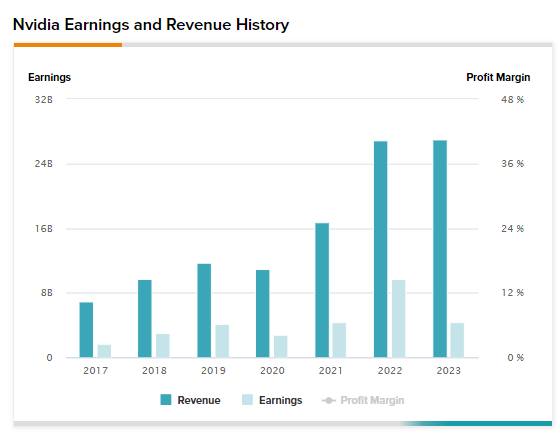

Is NVDA’s current efficiency merely a one-off occasion, although? Let’s analyze its efficiency over an extended timeframe. Trying on the final six years, NVDA’s revenues have virtually quadrupled from $6.9 billion in Fiscal 2017 to $26.9 billion in Fiscal 2023 (NVDA’s fiscal 12 months ends in January as an alternative of December). What’s additionally applaudable is that its earnings have grown by 2.6x from $1.67 billion to $4.4 billion over the identical interval.

This information offers a considerable sense of reassurance within the strong enterprise fundamentals and development trajectory NVDA has persistently maintained through the years, even earlier than the onset of the AI growth.

The AI Progress Story is Right here to Keep — NVDA Will Profit Enormously

Nvidia inventory achieved a market capitalization of over $1 trillion in June 2023, making it the ninth firm to achieve this milestone. Whereas some could imagine that the potential of AI has already been absolutely realized, they might be mistaken.

I imagine the AI development story is right here to remain, because the AI trade continues to be in its infancy and anticipated to proceed delivering distinctive development. The truth is, the trade is predicted to change into a $1.85 trillion trade by 2030 versus roughly $207.9 billion in 2023, based on Subsequent Transfer Technique Consulting.

NVDA, particularly, has unmistakably demonstrated its dominant place within the AI trade in current quarters. Providing a complete vary of providers, together with AI supercomputers, algorithms, information processing, and coaching modules, NVDA holds a aggressive edge over its rivals within the AI market. Moreover, NVDA stays on the forefront of innovation, solidifying its place as a number one supplier of AI providers throughout varied industries.

Because of this, NVDA is considerably forward of its closest opponents. The corporate’s scale and dominant market share within the AI sector have led to exceptional top-line and bottom-line development over the previous quarters.

In gentle of this, NVDA’s income development is more likely to proceed unabated. The truth is, Wall Avenue analysts mission NVDA revenues to double by the top of Fiscal 2024 in comparison with Fiscal 2023 and practically triple from 2023’s baseline by the top of Fiscal 2025.

In the meantime, NVDA’s EPS can be projected to surge to round $10.50 by the top of Fiscal 2024 and to $16 by the top of Fiscal 2025. These are certainly formidable projections, however given NVDA’s observe file of development, they don’t seem to be inconceivable to achieve.

On one other be aware, Nvidia CEO and co-founder Jensen Huang bought $42 million price of NVDA shares just lately. Does this counsel that the highest administration believes it’s time to begin taking income? It may, however quite the opposite, the corporate initiated a buyback program price $25 billion, signaling to the investor group that the inventory is probably going nonetheless undervalued relative to its true potential.

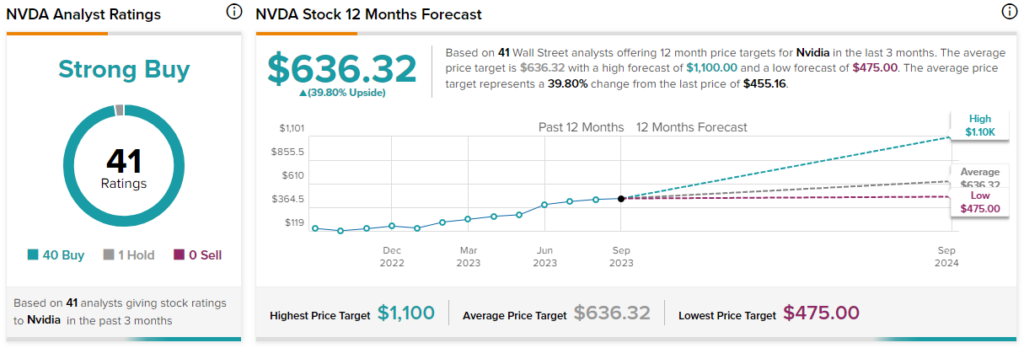

Is NVDA Inventory a Purchase, In response to Analysts?

NVDA is that elusive titan — a extensively coated inventory on which just about each analyst is in accord. Provided that it has obtained 39 Purchase scores and one Maintain from analysts within the final three months, it has a Sturdy Purchase consensus ranking. The common NVDA inventory goal worth of $636.32 implies 39.8% upside potential.

Breaking the Fantasy: NVDA’s Valuation Isn’t Costly

When it comes to its valuation, NVDA is presently buying and selling at a ahead P/E a number of of 42x. At first, this may increasingly look costly. Nevertheless, it is a a lot decrease stage in comparison with the P/E of 135x it was buying and selling at simply six months again. Additional, its competitor Intel (NASDAQ:INTC) is buying and selling at a lot greater ranges (61x ahead P/E), although INTC has simply begun its mark within the AI world and stays far behind NVDA.

The Takeaway

The undeniable fact is that Nvidia holds a management place within the AI market. The insatiable demand for AI chips ought to maintain the inventory’s multi-year development trajectory. Whereas some traders may money in on NVDA inventory, I imagine the occasional dips signify shopping for alternatives for many who imagine within the agency’s means to maintain performing effectively.

Consequently, that is my method: I’ll persist in buying NVDA inventory, even when it hovers close to its all-time highs, seizing the alternatives offered by occasional dips as they come up.

Disclosure