sitox

I used to be a kind of individuals who have been skeptical about Nvidia Company’s (NASDAQ:NVDA) progress potential as a result of improve in geopolitical dangers. I additionally modified my thoughts just a few months in the past when the corporate aggressively elevated its steerage simply as I used to be testing varied generative AI apps to enhance my workflow effectivity.

Since Nvidia lately launched one other spectacular earnings report which indicated that the corporate’s progress story is much from over, I are inclined to consider that it’s unlikely that its shares will drastically depreciate anytime quickly given all of the momentum that the enterprise has. On the similar time, there are additionally causes to consider that regardless of having over $1 trillion in market cap, Nvidia’s inventory shouldn’t be actually overvalued and will recognize additional within the following quarters.

Nvidia’s Development Story Is Not Over But

My newest article on Nvidia was revealed simply earlier than the corporate launched its current earnings outcomes for Q2. I argued that it’s essential for the administration to as soon as once more overdeliver in order that the enterprise retains its momentum. That’s precisely what has occurred, as Nvidia’s revenues in Q2 elevated by 101.6% Y/Y to $13.51 billion and have been above expectations by $2.43 billion because of the surge in knowledge middle gross sales. On the similar time, the corporate’s non-GAAP EPS in the course of the interval was $2.70, above the estimates by $0.61. Along with that, Nvidia as soon as once more stunned everybody by updating its outlook for Q3 the place it expects to generate $16 billion in revenues, above the consensus of $12.42 billion.

There are a number of causes to consider that Nvidia might obtain that concentrate on. Initially, the generative AI business is anticipated to develop at a CAGR of over 40% within the following decade, which already makes it doable for Nvidia to broaden its complete addressable market, or TAM, at the same charge because the business grows. On high of that, there’s a sign that Nvidia’s flagship H100 GPUs will probably be bought out properly into the following yr and the corporate is anticipated to triple the output of its chips to as much as 2 million in 2024, up from round 500,000 items that the corporate is anticipated to provide this yr. On the similar time, Nvidia’s foundry companion Taiwan Semiconductor (TSM) lately acknowledged that the demand for Nvidia’s chips will persist for the following yr and a half, which provides causes for optimism in regards to the firm’s future.

What’s extra, is that earlier this month Nvidia has submitted its first benchmark outcomes for the upcoming Grace Hopper tremendous chip that’s going to be extra highly effective than H100 and is anticipated to be launched in 2024. Along with that, there are causes to consider that the corporate is working with TSMC on the silicon photonics tech to develop next-generation chips, and vital orders for them are anticipated to be positioned later in 2024.

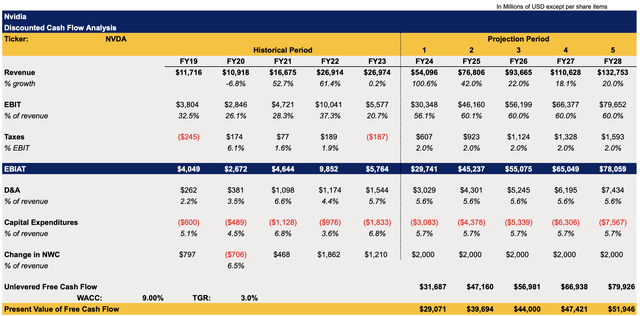

Contemplating all of this, it is sensible to consider that Nvidia’s progress story is much from over. Nevertheless, questions at the moment are being raised about whether or not the corporate’s inventory has an upside left as properly because it already aggressively appreciated and now trades at over $1 trillion market cap. To reply these questions, I’ve made a brand new discounted money move (“DCF”) mannequin that now could be extra intently aligned with the most recent Avenue forecasts which recommend that the corporate would proceed to develop at an aggressive charge in years to return.

The income and earnings assumptions within the mannequin are principally in-line with the Avenue estimates. The tax charge is minimal, as Nvidia makes use of a number of offshore jurisdictions for tax optimization functions. All of the assumptions for different metrics within the mannequin are much like the corporate’s historic data. The WACC within the mannequin stands at 9% whereas the terminal progress charge is 3%.

Nvidia’s DCF Mannequin (Historic Information: Searching for Alpha, Assumptions: Creator)

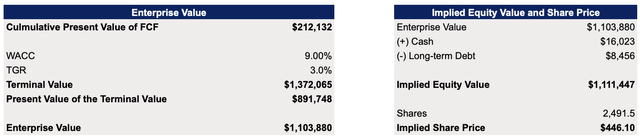

This DCF mannequin exhibits that Nvidia’s truthful worth is $446.10 per share, which is near the present market value.

Nvidia’s DCF Mannequin (Historic Information: Searching for Alpha, Assumptions: Creator)

Nevertheless, contemplating that the consensus on the Avenue is that Nvidia’s truthful worth is over $600 per share, it’s doable that the upside might be larger than I at present estimate. Add to all of this the truth that tech corporations nearly all the time commerce at a big premium, and we might assume that my DCF might be too conservative given the forecasted aggressive progress of the general generative AI business within the following years.

A number of Dangers To Contemplate

Regardless of these progress catalysts described above, it’s essential to grasp {that a} weaker progress of the general world financial system might however end in a weaker progress of Nvidia’s gross sales. Whereas it’s unlikely to be the case now, as varied reviews point out that the corporate sells its superior GPUs at a 1000% revenue margin, the macro challenges might undermine Nvidia’s progress story within the long-term.

On high of that, despite the fact that the geopolitical dangers decreased since final October when the Biden administration introduced new export restrictions on superior chips to China, it could nonetheless be too naive to suppose that such dangers gained’t return sooner or later. Final month, the U.S. has already expanded the export restrictions to a number of international locations within the Center East. On the similar time, Nvidia lately warned that additional restrictions might damage American corporations, as its personal knowledge middle gross sales to China account for 20% to 25% of the general knowledge middle gross sales. As such, potential additional restrictions would definitely negatively have an effect on Nvidia’s efficiency and will undermine the bullish thesis.

The Backside Line

Regardless of the entire macro and geopolitical dangers, the most recent gross sales knowledge together with the improved steerage level to the truth that Nvidia Company’s progress story is much from over and its inventory has extra room for progress. Whereas the corporate’s shares lately barely depreciated together with the remainder of the market, I count on them to rebound within the foreseeable future as they’ve a robust technical help degree of round $400 per share whereas the general enterprise nonetheless has momentum going for it. As such, I’m planning on opening a protracted place within the firm quickly and can seemingly maintain it for the long-term since there are causes to consider that Nvidia will proceed to energy the present generative AI revolution for years to return.

Nvidia’s Inventory Efficiency (Searching for Alpha)

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.