-

Web Gross sales: This autumn web gross sales rose 5.5% to $501.7 million, and annual web gross sales elevated 4.6% to $2.2 billion.

-

Gross Revenue: This autumn gross revenue surged 9.9% to $220.5 million, with a gross margin improve to 43.9%.

-

Web Revenue: 2023 web earnings per diluted share grew 6.5% to $8.26.

-

Dividends and Buybacks: Declared a $0.27 per share dividend and repurchased $50.0 million in frequent inventory in 2023.

-

Operational Challenges: Increased working bills led to a 9.1% lower in earnings from operations to $71.6 million in This autumn.

-

Money Circulation: Money offered by working actions decreased to $31.7 million in This autumn, a $104.7 million decline from the earlier yr.

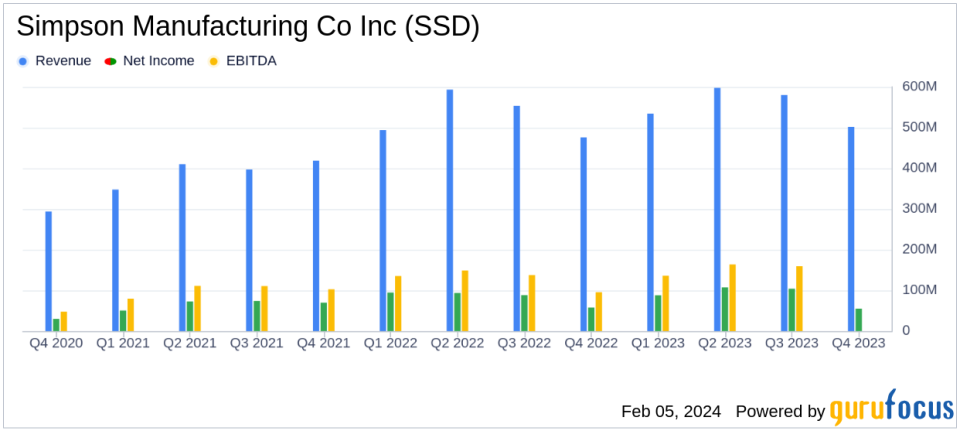

Simpson Manufacturing Co Inc (NYSE:SSD), a number one producer of engineered structural connectors and constructing options, launched its 8-Ok submitting on February 5, 2024, detailing its monetary outcomes for the fourth quarter and full yr of 2023. The corporate, which provides merchandise to residential, mild industrial, and business building markets, in addition to the reworking and do-it-yourself markets, primarily in america, reported a year-over-year improve in web gross sales and web earnings per diluted share.

Monetary Efficiency and Challenges

The corporate’s efficiency within the fourth quarter confirmed a 5.5% improve in consolidated web gross sales, amounting to $501.7 million. This development was pushed by greater gross sales volumes in North America and the constructive affect of overseas forex translation in Europe. Gross revenue for the quarter additionally noticed a major improve of 9.9%, reaching $220.5 million, with consolidated gross margin enhancing to 43.9% from 42.2%. The rise in gross margin was attributed to decrease uncooked materials and labor prices as a proportion of web gross sales.

Regardless of these achievements, Simpson Manufacturing confronted challenges within the type of elevated working bills, which led to a 9.1% lower in consolidated earnings from operations, right down to $71.6 million. The rise in working bills was primarily on account of greater personnel prices, skilled charges, and variable compensation. This was solely partly offset by the upper gross income.

Annual Highlights and Administration Commentary

For the complete yr, Simpson Manufacturing reported a 4.6% improve in consolidated web gross sales to $2.2 billion, with web earnings reaching $354.0 million, or $8.26 per diluted share, a 6.5% improve from the earlier yr. The corporate’s President and CEO, Mike Olosky, commented on the outcomes:

We achieved above market development and robust profitability in 2023 with $2.2 billion in annual web gross sales, a 21.5% working earnings margin and $8.26 of earnings per diluted share, stated Olosky. Our topline efficiency was pushed by continued share features throughout all of our finish markets and product traces.”

Olosky additionally famous the challenges confronted in North America and Europe, citing financial headwinds and decrease building exercise in Europe, whereas emphasizing the corporate’s strategic investments geared toward accelerating development.

Monetary Tables and Outlook

The corporate’s stability sheet stays strong, with money and money equivalents of $429.8 million as of December 31, 2023. The outlook for the fiscal yr ending December 31, 2024, contains an working margin estimated to be within the vary of 20.0% to 21.5%, and capital expenditures estimated to be roughly $200.0 million, which incorporates vital investments in facility expansions.

Simpson Manufacturing’s concentrate on strategic development and market share features, regardless of the operational challenges, positions the corporate to doubtlessly profit from the estimated scarcity of houses within the U.S. and the enhancing outlook for the development business in 2024. Buyers and analysts are invited to hitch the corporate’s monetary outcomes convention name for additional particulars on the efficiency and outlook.

For extra in-depth evaluation and up-to-date monetary data, go to GuruFocus.com, the place worth buyers and potential members can acquire entry to useful insights into Simpson Manufacturing Co Inc (NYSE:SSD) and different corporations.

Discover the whole 8-Ok earnings launch (right here) from Simpson Manufacturing Co Inc for additional particulars.

This text first appeared on GuruFocus.