Eduard Lysenko/iStock by way of Getty Photographs

The semiconductor and digital part market has been unstable over the previous 5 years. Earlier than 2020, and for someday after, demand for smartphones and related merchandise steadily rose worldwide, creating strong progress and demand for semiconductors. Since 2020, supply-chain points have brought on some turbulence for chipmakers as prices develop; nevertheless, these points had been closely offset by greater costs as a result of semiconductor shortages. Extra not too long ago, manufacturing ranges out there have typically normalized together with demand. That mentioned, as a result of lackluster demand, some elements of the semiconductor market are experiencing strains, significantly these most intently tied to smartphones.

Skyworks Options (NASDAQ:SWKS) is among the many most instantly uncovered to the smartphone semiconductor market. Round 59% of the corporate’s gross sales come instantly from smartphones and the remaining from numerous different end-products, of which round 1 / 4 are from automotive and industrial. In 2022, roughly 56% of the corporate’s gross sales got here from Apple (AAPL) alone, together with smartphones, tablets, watches, and computer systems. The agency’s different key prospects embody nearly all different smartphone and important {hardware} corporations. The agency’s merchandise are manufactured in its services in Japan, Singapore, Mexico, and the US, making it a core part of the worldwide digital provide chain.

SWKS has not fared in addition to most semiconductor corporations. Because the starting of 2022, SWKS has declined by round 29%, whereas the semiconductor ETF (SOXX) is almost flat. I used to be bearish on the inventory again in 2020, with it dropping about 25% of its worth since then. At the moment, I assumed the corporate may face supply-chain-related pressures and was overvalued as a result of unreasonable expectations surrounding 5G. Since then, we have seen extra widespread adoption of 5G; nevertheless, as anticipated, that has not boosted the corporate’s earnings dramatically as a result of the newer know-how replaces a dated one at an identical price. Additional, macroeconomic pressures and slower technological enhancements have led to a slowdown in smartphone gross sales. The corporate is seeing some progress in its automotive phase; nevertheless, that continues to be fickle as a result of uncertainty within the new car market.

Skyworks Smartphone Strains Might Develop

Traditionally, Skyworks extremely relies on smartphone gross sales for its earnings, primarily from Apple. Whereas it has taken steps to diversify away from smartphones and Apple, the portion of its whole gross sales from Apple solely declined by ~2-3% since 2020 (10K pg. 62). Additional, Apple’s whole world iPhone shipments have fallen by round 20% because the 2020 file (from seasonal peak to seasonal peak). Primarily based on TTM measures, the overall annual iPhone gross sales decline is nearer to 10%, though its 2020 gross sales had been irregular as a result of they had been significantly low throughout the starting of the 12 months as a result of lockdowns. On the similar time, Apple is making more cash on iPhones, primarily as a result of value hikes and revenue margin growth. Unit gross sales, that are extra related for Skyworks, are falling yearly. Whole world smartphone gross sales are additionally declining significantly, peaking round 2017 and down round 14% since.

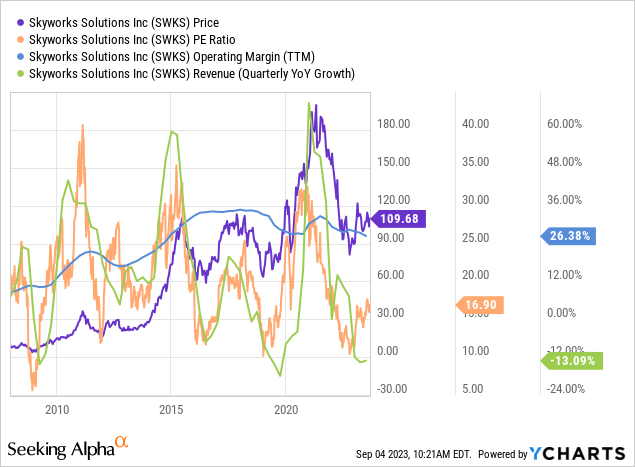

The smartphone slowdown is mirrored in Skyworks’ basic tendencies. Its valuation is low, associated to its gross sales decline. Its working revenue margin can be slipping, with an identical sample to whole world smartphone gross sales (peaking round 2017). See beneath:

SWKS’s “P/E” ratio of 16.9X is beneath its common degree of round 20X. That mentioned, its valuation intently tracks its annual gross sales progress -13% YoY. The corporate’s working margin can be trending decrease as its gross sales decline, and it loses its aggressive edge, implying its earnings will development decrease over the approaching 12 months or extra.

Basically, we should take into account the info and potentials of the smartphone market, together with Apple and others on which Skyworks relies upon. For one, Apple and different smartphone producers are vertically integrating chip manufacturing and can probably increase towards different digital parts produced by Skyworks. With working margins of 26%, smartphone producers will most likely discover vertical integration of digital manufacturing a pivotal strategy to develop or keep earnings within the present surroundings. Because the smartphone trade emerged round 2008, corporations like Skyworks have been essential to Apple, focusing totally on pursuing innovation whereas outsourcing most manufacturing. At this time, because the tempo of innovation continues to sluggish, corporations like Apple can not proceed to increase earnings by releasing new telephones. Nonetheless, they have to additionally give attention to vertical integration as they shift from progress to maturity.

In fact, because the tempo of innovation of smartphones naturally slows, folks can even exchange smartphones extra slowly. Apple and world smartphone annual unit gross sales are trending decrease as folks don’t really feel the necessity to exchange telephones to “sustain” as typically, given that the majority new fashions don’t have {hardware} a lot better than older ones. This sample is anticipated to develop over the approaching years by means of a minimum of 2027, implying unit gross sales volumes ought to proceed to fall globally. Certainly, many anticipated the 5G rollout to trigger a surge in “improve” purchases, however most individuals had been hardly curious about it. Since 5G is probably going essentially the most important technological {hardware} enchancment of this decade, smartphone improve pursuits will probably be decrease.

This difficulty is essentially the most important for Skyworks as a result of it’s going to each negatively impression its gross sales and probably dramatically hamper its working margin because it begins to compete with its vertically integrating prospects. Apple is conscious of this development and is reacting by elevating costs (to account for decrease annual unit gross sales) and utilizing its earnings to put money into vertical integration. Skyworks’ largest buyer is following the identical sample as any firm in an trade shifting from progress towards maturity, and sadly, that may nearly definitely hurt its earnings as Apple’s outsourcing wants decline.

Waning Shopper Demand Provides Uncertainty

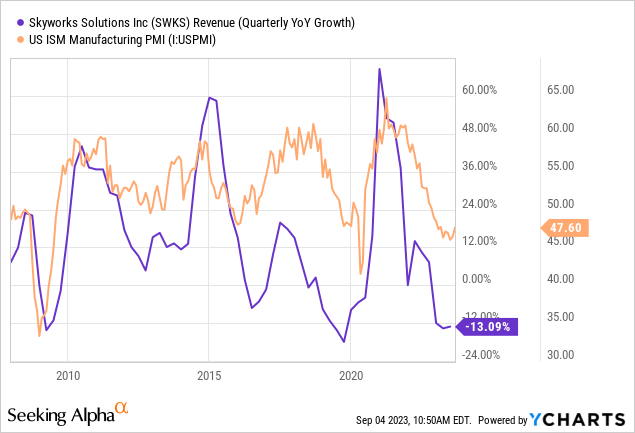

Skyworks is a cyclical firm as a result of most of its finish merchandise are offered to customers (smartphones, computer systems, automobiles, and so on.), of which most are higher-cost objects. When extra financial demand is robust, folks desire shopping for higher-cost objects with Skyworks digital parts. At this time, financial information is a bit muddled by inflation and volatility in commodity costs; nevertheless, the manufacturing PMI factors towards a decline in industrial exercise. Traditionally, that measure has a substantial relationship with Skyworks gross sales tendencies. See beneath:

There’s definitely not an ideal correlation between these two figures, however the peaks and troughs often coincide. At this time, the manufacturing PMI is as little as it has been since 2008, excluding the substantial non permanent decline in 2020. Skyworks gross sales are additionally falling fairly rapidly after strong progress in 2021, coinciding with the huge rebound within the PMI. So long as the PMI is beneath 50, we will anticipate typically adverse tendencies in manufacturing exercise, suggesting that Skyworks could lose gross sales as a result of macroeconomic pressures.

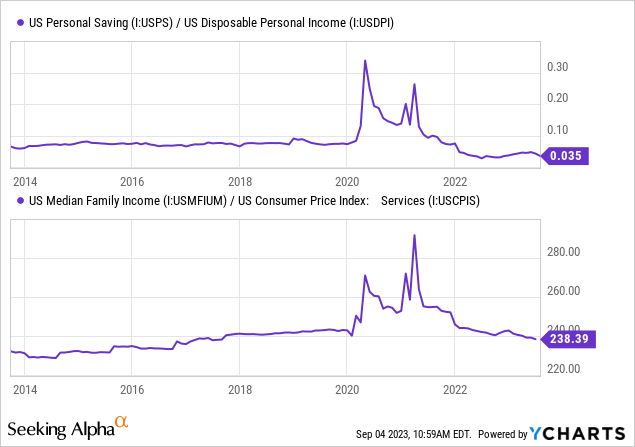

Within the US, financial demand is popping sharply in a adverse route as a result of financial savings and actual median household earnings declines. Private financial savings are round 3.5% of disposable earnings, a lot decrease than earlier than 2020. Median household incomes in comparison with providers costs are additionally decrease at about 2017 ranges. See beneath:

For my part, the development in providers costs (hire, healthcare, and so on.) in comparison with incomes is essentially the most telling as a result of that issue is much less influenced by commodity value volatility. As described in “BND: Why Bonds Might Crash Quickly – A Deep Dive Into Inflation,” inflation would nonetheless be round 6.1% right this moment if commodity impacts had been excluded – that means it might rise if commodities don’t proceed to say no. Additional, the actual GDP based mostly on service costs has stagnated because the finish of 2021, mirroring the tendencies most US households and companies felt.

Skyworks is tied to world client tendencies, not simply the US. Nonetheless, the US development is mostly telling of the worldwide development. Key progress markets, reminiscent of China, could be even worse as a result of nation’s large financial pressures, a truth the nation is struggling to maintain beneath wraps. In fact, even US information could also be overstated as a result of adverse revisions in jobs and progress information. The Eurozone can be in an financial recession, probably implying its historic monetary points could return to the floor.

Skyworks is a really macroeconomically uncovered firm, and the broad world financial development for client energy is undoubtedly adverse. The corporate has been dropping gross sales primarily as a result of a decline in smartphone gross sales, associated primarily to technological enchancment slowdowns. Trying ahead, I anticipate that development to proceed, compounded by decrease financial demand for smartphones, computer systems, automobiles, and different key merchandise, as households are compelled to cut back spending to make up for decrease private financial savings. Additional, Skyworks could lose important gross sales and profitability in the long term as a result of competitors from its vertically integrating prospects.

The Backside Line

For my part, Skyworks’s strain within the smartphone market is massive sufficient that I anticipate its whole annual gross sales will proceed to say no, probably previous 2024. Analysts anticipate its gross sales and EPS to backside across the present quarter and rebound afterward. This bullish outlook could also be as a result of hopes for a smartphone gross sales rebound with the iPhone 15 launch. Nonetheless, I strongly suspect that iPhone 15 demand is not going to be as robust as previous launches as a result of its specs are marginally improved, roughly equal to an iPhone 14 Professional. In fact, the worth is greater regardless of client disposable spending headwinds. Thus, I’m personally keen to wager that the iPhone 15 will likely be probably the most disappointing in Apple’s historical past. Additional, I typically anticipate Skyworks earnings from Apple will fall as these points proceed over the approaching years, probably compounded by strain as the corporate vertically integrates.

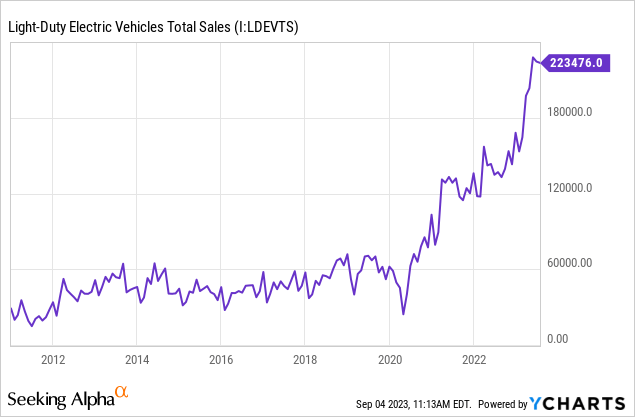

Digital automobiles are a silver lining as Skyworks expands and quickly grows in that market. EV gross sales are additionally booming in comparison with pre-2020 ranges. See beneath:

Undoubtedly, financial headwinds will create pressures for EV gross sales. Additional, solely a smaller portion of Skyworks’ whole gross sales comes from car parts. This phase will likely be an important issue for the corporate because it shifts focus away from the maturing smartphone market to the rising EV trade. Will its new EV gross sales exchange misplaced smartphone gross sales? Maybe I’d not closely wager on it since Skyworks continues to be so depending on Apple.

Total, I’m barely bearish on SWKS and consider it’s going to most probably lose worth over the approaching 12 months because it fails to see its gross sales and EPS rebound, as analysts anticipate. Additional, I believe there’s appreciable threat that its gross sales and working margins fall over the approaching years as a result of tendencies within the smartphone market and the financial system at massive. I consider its TTM “P/E” of 16X will not be low sufficient to account for the possibly important EPS decline it could proceed to expertise. Whereas I’d quick AAPL right this moment, I’d not wager towards SWKS as a result of its valuation will not be excessively excessive, and it may ultimately see ample progress in non-smartphone markets.