Tremendous Micro Laptop (NASDAQ:SMCI) has continued its dramatic ascent as traders ponder the corporate’s long-term potential. The corporate acquired a head begin with AI servers and cornered the market final 12 months. Excessive income and earnings progress fueled an enormous rally that has resulted in a 1,050% acquire over the previous 12 months. The agency is now price over $62 billion. Whereas the inventory can nonetheless experience larger due to excessive AI demand and analyst value hikes, the long-term perspective has a couple of key dangers to think about.

I’m impartial on SMCI as a result of it’s inconceivable to foretell how far a rally can carry a inventory. Nonetheless, I can rapidly turn into bearish if not less than one of many long-term dangers mentioned beneath turns into extra important.

The Dimension of the AI Pie

Tremendous Micro Laptop has loved comparatively little competitors for many of 2023, however that seems to be altering. Dell (NYSE:DELL) reported a large backlog for its AI servers and indicated that extra progress is on the way in which. The tech big reported a 40% quarter-over-quarter enhance in AI server orders.

Companies are making massive investments in synthetic intelligence, however these investments will ultimately decelerate. Earlier than massive corporations cut back their spending, different server corporations will seize their slice of the pie.

Dell has already began and now presents a viable various to Tremendous Micro Laptop. These two corporations can enter a pricing conflict that leads to decrease income for each of them. Hewlett Packard Enterprise (NYSE:HPE) can be entering into AI servers, which is able to lead to much more pricing strain.

SMCI is priced as if it doesn’t have any competitors, however that may change in the long term. The company can expertise strain on its inventory value earlier than different opponents acquire market share if varied companies resolve to tug again on AI spending.

Revenue Margins Didn’t Improve because the Enterprise Grew

A giant part of Nvidia’s (NASDAQ:NVDA) rally has been its rising revenue margins. The AI big closed its fourth quarter of Fiscal 2024 with a web revenue margin above 50%. Moreover, GAAP web revenue progress outpaced Nvidia’s inventory positive factors.

Quite the opposite, Tremendous Micro Laptop’s revenue margins worsened in its second quarter of Fiscal 2024. Its web revenue margin was solely simply above 8% in comparison with a web revenue margin above 9% throughout the identical interval final 12 months.

Bullish traders will make the argument {that a} slight dip in revenue margins doesn’t matter because the firm reported 68% year-over-year web revenue progress. It’s a good level, however the business’s status for low-profit margins doesn’t supply a lot upside in that space.

SMCI is presently counting on income progress to gas larger income. Income progress charges seem to be the ceiling in the meanwhile, which could be troubling when income progress slows down. The agency’s steerage suggests $3.7 billion to $4.1 billion in complete income for the third quarter of Fiscal 2024. SMCI’s $3.66 billion in Q2 FY24 income means present projections counsel a quarter-over-quarter progress fee of 1.1% to 12%.

Traders can argue that progress is already slowing down if income comes throughout the $3.7 billion to $4.1 billion vary. Combining a number of experiences with low quarter-over-quarter progress charges will ultimately lead to a complete 12 months of low progress. That growth will decrease the corporate’s web revenue positive factors. Earnings progress over the previous 12 months is already drastically behind inventory positive factors over the previous 12 months. That’s regarding.

Tremendous Micro should exceed steerage to show the expansion story is powerful since traders already anticipate income going as excessive as $4.1 billion.

Everybody’s Speaking In regards to the Valuation

It’s inconceivable to have a dialog about SMCI with out mentioning its valuation. Bulls will argue that Tremendous Micro Laptop inventory has an affordable valuation primarily based on future progress prospects, whereas bears will declare the valuation is elevated and gives restricted upside.

A excessive valuation isn’t all the time a foul factor. Some shares develop into their valuations as they discover new alternatives and broaden their revenue margins. Nonetheless, the 2 issues talked about earlier compound the importance of SMCI’s lofty valuation.

Its valuation has earned it comparisons to dot-com shares like Qualcomm (NASDAQ:QCOM), which soared as new expertise gained speedy demand. Qualcomm loved an awesome run and surged by roughly 3,000% from January 1996 to January 2000. It had the kind of fanfare that SMCI inventory enjoys right now.

Fiscal years that resulted in 1996 and 1997 featured triple-digit year-over-year income progress. The fiscal 12 months resulted in 1998 had roughly 60% year-over-year income progress. The inventory derailed in 2000 after reporting destructive income progress in that 12 months. The corporate additionally reported destructive income progress in 2001.

Tremendous Micro Laptop isn’t more likely to observe the identical precise path as Qualcomm, however historical past rhymes. SMCI inventory could have one 12 months left earlier than it implodes, or it may have 5 years remaining. If quarter-over-quarter income progress falls beneath 10%, we are able to see the previous fairly than the latter.

Is Tremendous Micro Laptop Inventory a Purchase, In response to Analysts?

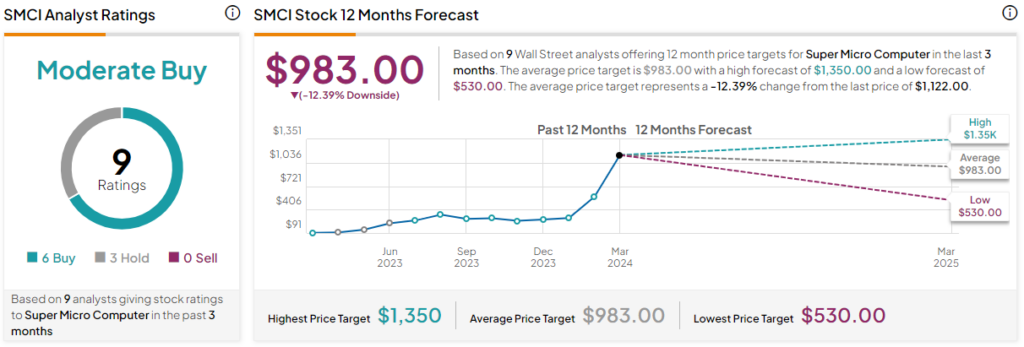

Tremendous Micro Laptop inventory has a Reasonable Purchase score primarily based on six Buys and three Holds assigned previously three months. The typical SMCI inventory value goal of $983 suggests shares will drop by 12.4%.

The Backside Line on SMCI Inventory

The inventory’s rally has been getting uncontrolled. The corporate can assuage critics by beating income estimates, making the inventory’s quarter-over-quarter progress fee extra spectacular. This progress issues greater than year-over-year income progress since traders already anticipate that the inventory will ship a triple-digit progress fee on that entrance.

Valuation isn’t the one concern, although. Rising competitors, the prospect of companies pulling again on their spending, and low revenue margins additionally play a job. SMCI is priced as if the company is not going to encounter any of those issues, however they’re notable dangers.

SMCI began out as an undervalued inventory close to the top of 2023. Nonetheless, the inventory’s 295% year-to-date acquire doesn’t depart a margin of security since web revenue ‘solely’ elevated by 68% year-over-year.

Disclosure