The disk/SSD downcycle low level has been reached for Western Digital with its second successive sequential income progress quarter.

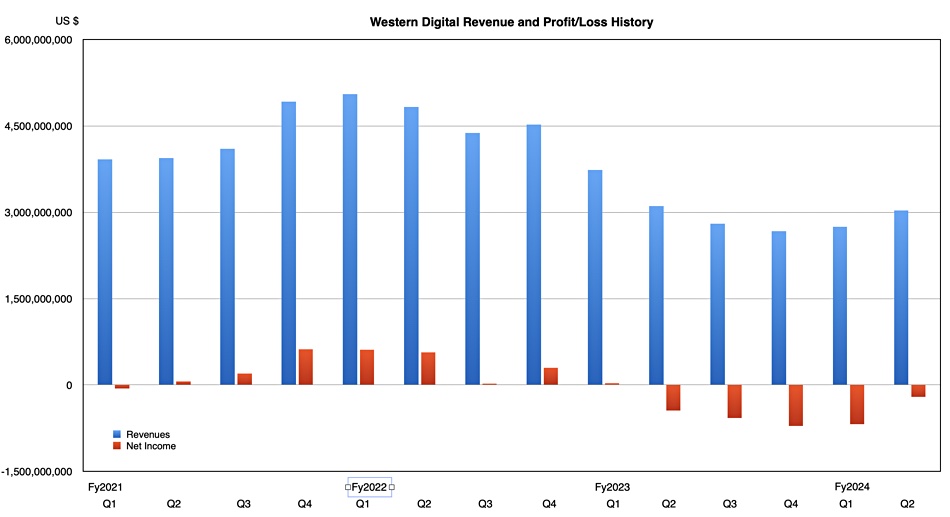

Revenues within the second quarter of its fiscal 2024, ended December 29, have been $3.03 billion, two p.c down yer-on-year however up 10 p.c sequentially. There was a lack of $268 million, decrease than the year-ago $446 million loss. The charted sample of quarterly outcomes clearly exhibits a trough has bottomed out:

WD CEO David Goeckeler stated in a canned assertion: “Western Digital’s second quarter outcomes display that the structural modifications we’ve put in place over the previous few years and the technique we’ve been executing are producing vital outperformance throughout our flash and HDD companies.”

Overshadowing the outcomes [PDF] are WD’s resolution to separate its HDD and SSD items into separate companies and Seagate’s newly opened-up capability and density lead with its HAMR tech – however we’ll end with the quarter’s numbers earlier than getting to those points.

Monetary abstract

- Gross margin: 16.2% vs 17% a 12 months in the past

- Working money move: $92 million

- Money and money equivalents: $2.48 billion

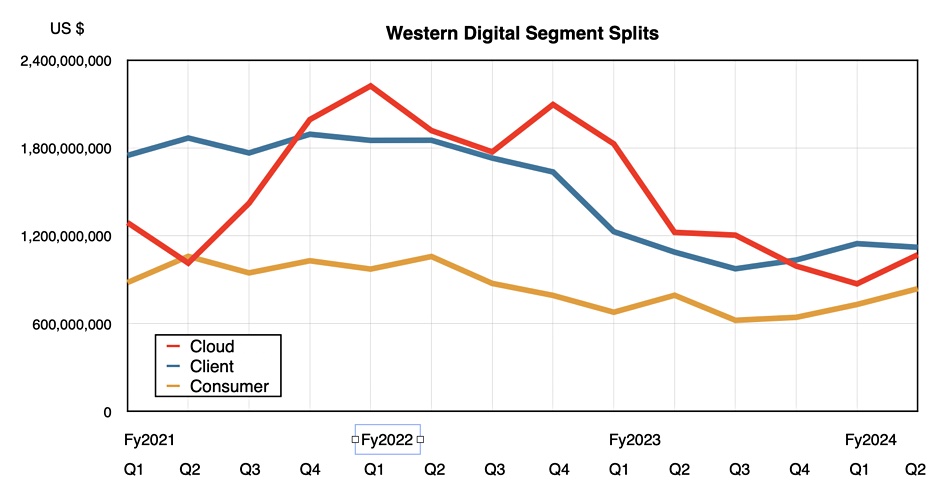

WD sells its SSDs and HDDs into three markets: cloud (enterprise and CSP), consumer (PC and pocket book), and client (retail). The consumer ($1.1 billion, up 3% y/y) and client ($839 million, up 6% on seasonal shopping for) segments grew year-on-year whereas cloud ($1.1 billion, down 13%) went downhill year-on-year however rose an encouraging 23 p.c sequentially;

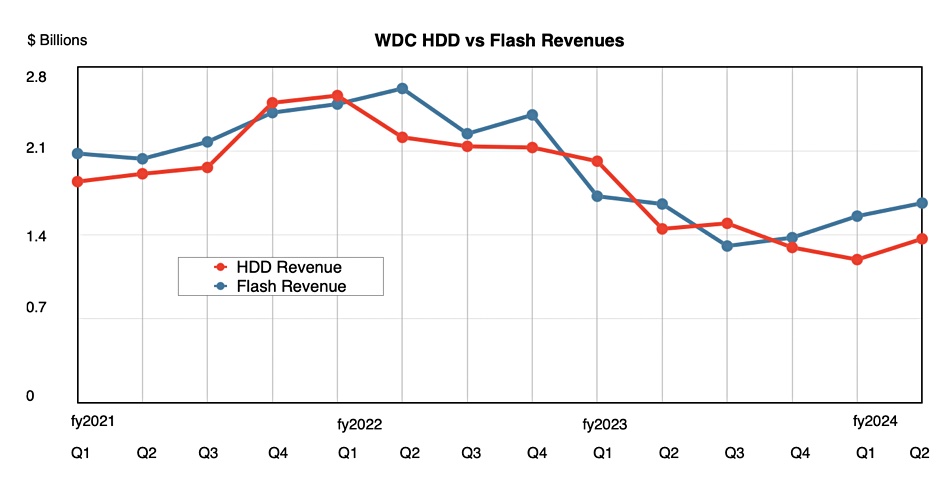

Its flash-based revenues have been $1.7 billion within the quarter, flat year-on-year, whereas HDD revenues at $1.4 billion have been down six p.c, though up sequentially. Goeckeler stated: “The sequential income enhance was pushed by enhancing nearline demand and pricing. Furthermore, we’re inspired by demand in China with income doubling on a sequential and year-over-year foundation, each of which have been forward of our expectations. We anticipate year-over-year progress in HDD all through this calendar 12 months.”

WD stated its WD_BLACK gaming SSD merchandise achieved report income with bit cargo progress of over 50% year-over-year.

SMR (shingled magnetic recording) disk drives have been essential as WD shipped roughly a million UltraSMR exhausting drives in each the primary and second quarters of fiscal 2024. It expects SMR drive shipments to comprise nearly all of nearline demand by calendar 12 months 2025. Goeckeler stated: “SMR drive shipments to proceed to outgrow that of CMR drives going ahead. Importantly, the adoption of UltraSMR is broadening to our main clients worldwide together with a 3rd cloud titan within the US this 12 months, in addition to hyperscale and sensible video clients in China.”

Goeckeler added: “The sequential income enhance was pushed by enhancing nearline demand and pricing. Furthermore, we’re inspired by demand in China with income doubling on a sequential and year-over-year foundation, each of which have been forward of our expectations. We anticipate year-over-year progress in HDD all through this calendar 12 months.”

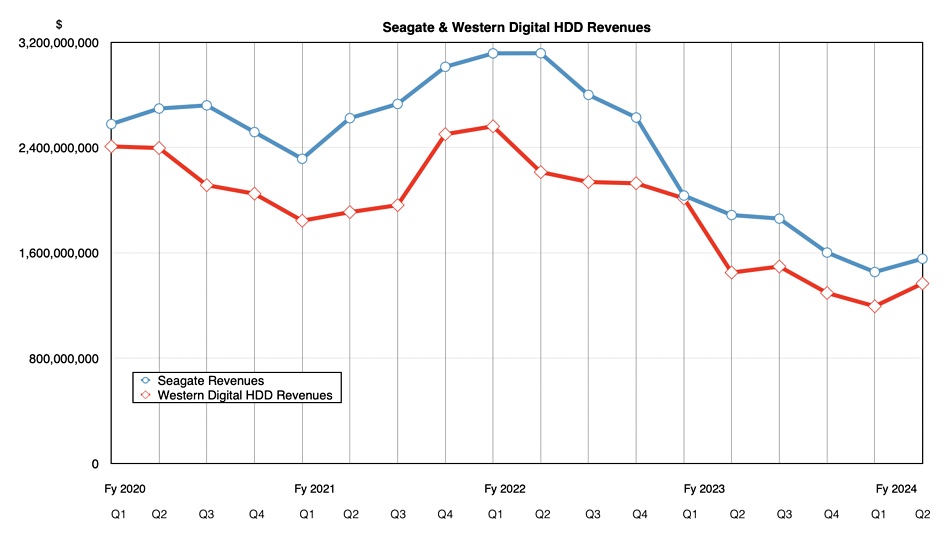

WD’s disk revenues grew a little bit nearer to {industry} chief Seagate’s as a chart exhibits;

Earnings name

Goeckeler was optimistic in regards to the future in an earnings name with analysts on Thursday, saying: “Along with the restoration in each flash and HDD markets, we imagine storage is getting into a multiyear progress interval … We imagine the second wave of generative AI-driven storage deployments will spark a consumer and client gadget refresh cycle and re-accelerate content material progress in PC, smartphone, gaming, and client within the coming years. Our flash portfolio is extraordinarily effectively positioned to profit from this rising secular tailwind.”

His ready HDD remarks appeared, we stress “appeared,” inappropriate as Seagate has simply introduced its 30 TB and 32 TB HAMR drives, beating WD’s 24 TB PMR and 28 TB SMR disks capacity-wise. Goeckeler stated: “In HDD, Western Digital’s main ePMR platform and enhanced UltraSMR expertise permit us to offer the highest-capacity drives for mass market deployment.” Nicely, truly they gained’t, or will they?

He continued: “We’ve got a powerful conviction that our portfolio technique of first commercializing Western Digital’s industry-leading UltraSMR expertise, which shall be adopted by our transition from ePMR to HAMR provides the perfect TCO to our clients in each the close to and long run whereas delivering main portfolio profitability within the {industry}.”

Then he stated: “Over the subsequent a number of years, we shall be introducing numerous thrilling merchandise, together with a number of generations of nearline drives, combining ePMR, OptiNAND, and UltraSMR applied sciences within the 30 to higher 30-terabyte capability vary, all of which shall be prepared for high-volume manufacturing to assist the explosion of AI coaching information and content material.”

However Seagate is speaking about delivery 40+ TB drives in two years. On this foundation WD is falling behind. However, in answering a query on the decision, Goeckeler stated he sees it in a different way: ”I can let you know our clients have an unlimited quantity of confidence in our highway map, in our present merchandise, and also you’re seeing that within the efficiency of the enterprise. You’re seeing accelerating progress, you’re seeing higher profitability, you’re seeing share good points, that’s a transparent indication that clients are very pleased with our merchandise.”

Additionally: “For our portfolio, given our UltraSMR expertise; it’s been adopted by the market. HAMR doesn’t make sense till you get to 4 terabytes per platter and since HAMR provides a number of prices to the product … We are going to transition to HAMR after we get to that 4 terabytes per platter, that’s the financial crossover, proper, that we’re in search of from a portfolio administration viewpoint.”

Forty terabytes is in attain with WD’s current expertise, Goeckeler stated: “We’ve constructed a expertise highway map that permits us to get to 40 terabytes on very well-proven, cost-controlled, excessive manufacturing capability expertise. And we’re trying ahead to delivering that to the market over the subsequent couple of years.”

NAND and SSDs

Within the flash space Goeckeler stated: “We stay on monitor to ramp an array of QLC-based consumer SSDs using BiCS6 expertise. Our capability to mix this new high-performance node with our in-house controller improvement permits us to supply a portfolio of consumer SSDs with unmatched efficiency and worth. We count on these merchandise to guide the transition to QLC flash in calendar 12 months 2024. Moreover, BiCS8 yield is progressing effectively, and we stay on monitor to productize this expertise.”

However WD won’t enhance flash manufacturing capability, with Goeckeler saying: “Though flash pricing has began to extend, our profitability and money technology proceed to be effectively under the extent that justify a rise in capital investments. We anticipate wafer gear spending will stay at historic lows within the close to time period and flash to be undersupplied for an prolonged time frame. General, we’ll proceed to deal with allocating our bids to probably the most engaging finish markets and anticipate flash ASP will increase to be the first income progress driver all through this calendar 12 months.” Value will increase will drive WD flash revenues larger.

The approaching break up between WD’s HDD and NAND/SSD companies was not mentioned. Wells Fargo’s Aaron Rakers expects an analyst day assembly within the mid to late-summer timeframe to deal with this.

Subsequent quarter’s outlook is for revenues of $3.3 billion +/- $0.1 billion, which shall be a 17.7 p.c enhance on the year-ago Q3. Let the nice instances roll.