Western Digital has concluded its strategic evaluate and intends to separate its present onerous disk drive and flash/SSD companies into two separate publicly listed corporations by the second haf of calendar 2024.

The strategic evaluate was introduced in June final yr following enter from Western Digital shareholder and activist investor Elliott Administration, which calculated the flash and SSD a part of the enterprise was under-valued and overshadowed in investor sentiment phrases by the HDD division. The message was loud and clear: a standalone flash and SSD enterprise would have the next worth, and WD shareholders would profit from this.

WD CEO David Goeckeler confirmed the choice: “Separating these franchises will unlock vital worth for Western Digital shareholders, permitting them to take part within the upside of two business leaders with distinct development and funding profiles.”

He added that each the HDD and flash/SSD markets are rising from a protracted downcycle: “Transferring ahead, as we progress by means of fiscal yr 2024, we see an enhancing market atmosphere in each companies, and we are going to stay open to strategic alternatives that unlock additional worth in each our HDD and Flash investments and property.”

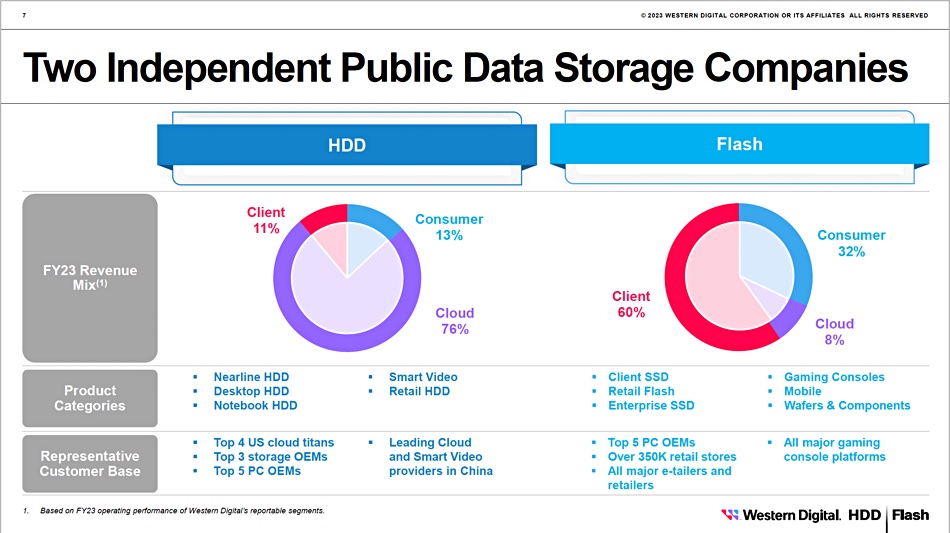

The HDD enterprise will probably be referred to as Western Digital, and the to-be-spun-out flash and SSD enterprise has but to be named. In WD’s first quarter for fiscal 2024, ended September 29, income generated by the flash/SSD division was $1.56 billion versus the HDD enterprise unit’s $1.19 billion.

The jewel within the crown for the Flash division is the three way partnership with Kioxia to manufacture NAND chips in Japanese foundries, with every firm constructing their very own SSDs utilizing the chips. WD estimates Kioxia had an 18 % share of the calendar 2022 NAND market, with WD having 13 %, which means a mixed 31 % share behind business chief Samsung with 34 % and forward of SK hynix (19 %) and Micron (12 %).

WD bought into the flash enterprise by shopping for SanDisk for $19 billion in 2015. SanDisk had a NAND fab joint-venture with Toshiba, which WD obtained by means of this transaction. Toshiba spun off its NAND enterprise into Kioxia in an $18 billion transaction with a Bain Capital-led consortium in September 2017.

An try and merge WD’s flash enterprise with Kioxia failed a number of days in the past when Kioxia shareholder SK hynix objected. It might appear seemingly that WD execs had been ready to see what occurred with Kioxia earlier than revealing the separation plan for the Flash unit.

The ultimate willpower to separate will probably be topic to WD board approval, the execution of definitive documentation, and receipt of opinions or rulings as to the tax-free nature of the transaction for shareholders which might be given shares within the spun-off flash enterprise. It additionally wants satisfaction of customary situations, together with effectiveness of acceptable filings with the U.S. Securities and Trade Fee, the completion of audited financials, and the supply of financing.

Western Digital stated its Board stays open to contemplating any alternate options that ship superior worth to the proposed separation ought to they grow to be out there. In the intervening time Ellliott Administration can look ahead to finishing one other activist investor engagement.