January 16, 2024, 08:20 am ET, BY Randall S.- Contributor| Editor: Thomas H. Kee Jr. (Comply with on LinkedIn)

Longer Time period Buying and selling Plans for SSD

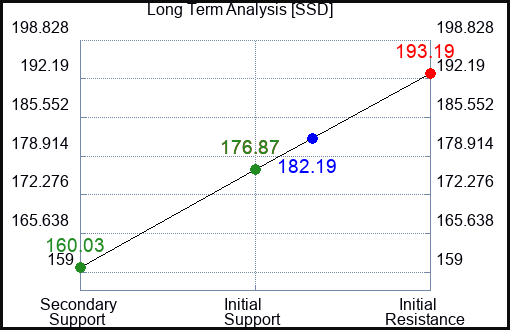

- Purchase SSD barely over 176.87 goal 193.19 cease loss @ 176.36 Particulars

The technical abstract knowledge tells us to purchase SSD close to 176.87 with an upside goal of 193.19. This knowledge additionally tells us to set a cease loss @ 176.36 to guard towards extreme loss in case the inventory begins to maneuver towards the commerce. 176.87 is the primary stage of assist beneath 182.19 , and by rule, any take a look at of assist is a purchase sign. On this case, assist 176.87 is being examined, a purchase sign would exist.

- Quick SSD just below 193.19, goal 176.87, cease loss @ 193.75 Particulars

The technical abstract knowledge is suggesting a wanting SSD because it will get close to 193.19 with a draw back goal of 176.87. We should always have a cease loss in place at 193.75though. 193.19 is the primary stage of resistance above 182.19, and by rule, any take a look at of resistance is a brief sign. On this case, if resistance 193.19 is being examined, a brief sign would exist.

Swing Buying and selling Plans for SSD

- Purchase SSD barely over 193.19, goal n/a, Cease Loss @ 192.63 Particulars

If 193.19 begins to interrupt increased, the technical abstract knowledge tells us to purchase SSD simply barely over 193.19, with an upside goal of n/a. The information additionally tells us to set a cease loss @ 192.63 in case the inventory turns towards the commerce. 193.19 is the primary stage of resistance above 182.19, and by rule, any break above resistance is a purchase sign. On this case, 193.19, preliminary resistance, can be breaking increased, so a purchase sign would exist. As a result of this plan relies on a break of resistance, it’s known as a Lengthy Resistance Plan.

- Quick SSD barely close to 193.19, goal 181.69, Cease Loss @ 193.75. Particulars

The technical abstract knowledge is suggesting a wanting SSD if it assessments 193.19 with a draw back goal of 181.69. We should always have a cease loss in place at 193.75 although in case the inventory begins to maneuver towards the commerce. By rule, any take a look at of resistance is a brief sign. On this case, if resistance, 193.19, is being examined a brief sign would exist. As a result of this plan is a brief plan primarily based on a take a look at of resistance it’s known as a Quick Resistance Plan.

Day Buying and selling Plans for SSD

- Purchase SSD barely over 183.02, goal 193.19, Cease Loss @ 182.59 Particulars

If 183.02 begins to interrupt increased, the technical abstract knowledge tells us to purchase SSD simply barely over 183.02, with an upside goal of 193.19. The information additionally tells us to set a cease loss @ 182.59 in case the inventory turns towards the commerce. 183.02 is the primary stage of resistance above 182.19, and by rule, any break above resistance is a purchase sign. On this case, 183.02, preliminary resistance, can be breaking increased, so a purchase sign would exist. As a result of this plan relies on a break of resistance, it’s known as a Lengthy Resistance Plan.

- Quick SSD barely close to 183.02, goal 181.69, Cease Loss @ 183.45. Particulars

The technical abstract knowledge is suggesting a wanting SSD if it assessments 183.02 with a draw back goal of 181.69. We should always have a cease loss in place at 183.45 although in case the inventory begins to maneuver towards the commerce. By rule, any take a look at of resistance is a brief sign. On this case, if resistance, 183.02, is being examined a brief sign would exist. As a result of this plan is a brief plan primarily based on a take a look at of resistance it’s known as a Quick Resistance Plan.

Actual Time Updates can be found on our Simpson Manufacturing Firm Inc. (SSD) Web page right here: SSD.

SSD Scores for January 16:

| Time period → |

Close to |

Mid |

Lengthy |

| Score |

Impartial |

Weak |

Robust |

| P1 |

0 |

0 |

160.03 |

| P2 |

180.51 |

175.61 |

176.87 |

| P3 |

183.02 |

181.69 |

193.19 |

Help and Resistance Plot Chart for SSD

Blue = Present Value

Crimson= Resistance

Inexperienced = Help

Actual Time Updates for Repeat Institutional Readers:

Directions:

-

Click on the Get Actual Time Updates button beneath.

-

Within the login immediate, choose forgot username

-

Kind the e-mail you utilize for Factset

-

Use the person/go you obtain to login

-

You should have 24/7 entry to actual time updates.

From then on you possibly can simply click on to get the true time replace everytime you need.

GET REAL TIME UPDATES

Our Market Crash Main Indicator isKeep away from Reduce.

-

Evitar Corte warned of market crash threat 4 occasions since 2000.

-

It recognized the Web Debacle earlier than it occurred.

-

It recognized the Credit score Disaster earlier than it occurred.

-

It recognized the Corona Crash too.

-

See what Evitar Corte is Saying Now.

Get Notified When our Scores Change:Take a Trial

This isn’t EF Hutton, however it might be extra #highly effective. An image speaks a thousand phrases, they are saying, and the #priceaction of Simpson Manufacturing Firm Inc. (NYSE: SSD) tells an necessary story. The motion tells us the place buyers understand worth, or the shortage of it, and if we concentrate we will seize alternative. The information beneath for SSD can be utilized for instance, and show how to do that for different shares too. This knowledge was present on the time of publication, however it isn’t up to date in actual time right here. If you’d like actual time updates, or knowledge on a distinct inventory, please get one right here Limitless Actual Time Stories.

Elementary Charts for SSD: